HFA Holdings Limited (HFA.AX) is a revaluation fraud with a long sordid history, including involvement with Bernie Madoff through its US subsidiary. HFA was listed by fraudulent investment scheme MFS Limited (later rebranded as Octaviar), that collapsed in 2008 owing more than $2.7bn, having destroyed the lives of thousands of granny investors. Later the carcass of the fraudulent "cornerstone investor" provided a feeding frenzy for maggot liquidators. The HFA criminals then blamed their woes on "bad publicity".

In 2011, the trustees of Bernie Madoff's defunct business launched lawsuits to claw back funds from investors in feeder funds to the Madoff ponzi. HFA subsidiary Lighthouse Investment Partners LLC was sued for $11,162,251, as shown in this complaint. Having learned their lesson about the dangers of "bad publicity", the HFA criminals suppressed this information from being reported in mainstream Australian media. Australian media just pretended this did not happen, despite it being highly pertinent information for any reasonable person attempting to form a view of the HFA business. In Australia, the criminals decide what information you are allowed to access.

The top 20 shareholders control 90% of HFA and manipulate its share price. Being a listed securities fraud, HFA exhibits the standard pattern of long-term catastrophic shareholder value destruction, interspersed with sharp engineered ramps to benefit insiders. In January 2014, Apollo Global Management announced it was looking to exit its convertible note investment in HFA. HFA was then ramped 30% by the investment cartel, as part of a prearranged deal.

According to ASIC, none of this is market manipulation because market manipulation simply does not exist. ASIC need do nothing about share ramps, because share ramps do not exist.

Section 17.6 on page 35 of the 2013 HFA annual report describes the "relationship between remuneration policy and company performance" with inadvertent humor. The company performance justifying payment of USD$4.6m to its criminal management, taken directly from the remuneration report, is shown below.

But operational performance is entirely irrelevant to HFA's utility as a vehicle for securities fraud. HFA is yet again being used in revaluation fraud targeting granny investors. After the prearranged January 2014 ramp, investment cartel associate IOOF Holdings Limited (IFL.AX) immediately started buying millions of HFA shares at around $0.95. To pay back Apollo, HFA raised $16m at $0.90 by issuing shares to the investment cartel. Since the "market" price of HFA now has been brought to $1.12, millions of dollars in fraudulent unrealized profits have been manufactured, creating vast fees for the fund manager investment cartel controlling HFA's share price. The deliberately pumped HFA shares have been dumped on granny investors, packaged in products issued by IOOF Holdings and other cartel associates.

IOOF Holdings and the rest of the HFA investment cartel are engaged in premeditated securities fraud. What is the real difference between Bernie Madoff and the HFA investment cartel? There is but one: Bernie Madoff is in prison.

Blog outlining massive fraud in the Australian listed investment company (LIC) and broader financial sector

Sunday, 6 July 2014

Saturday, 5 July 2014

Hill End Gold Limited to join LionGold and Blumont cartel

Hill End Gold Limited (HEG.AX) is a related party revaluation fraud masquerading as a gold explorer. Like other manipulated shares, Hill End Gold features long-term shareholder value destruction interrupted by sharp manufactured ramps designed to benefit insiders.

After burning through millions in shareholder funds, the Hill End Gold criminals were seemingly approaching the end of the line, with ASX querying the company's ability to continue operating. As part of its response, Hill End Gold cited a "liquid" holding in related party Bassari Resources Limited (BSR.AX). In March, Hill End Gold had announced it was increasing its stake in related party Bassari by converting a loan at $0.008, bringing its total holding in the company to 14.7%. Starting in June, Bassari was then ramped to $0.021.

After burning through millions in shareholder funds, the Hill End Gold criminals were seemingly approaching the end of the line, with ASX querying the company's ability to continue operating. As part of its response, Hill End Gold cited a "liquid" holding in related party Bassari Resources Limited (BSR.AX). In March, Hill End Gold had announced it was increasing its stake in related party Bassari by converting a loan at $0.008, bringing its total holding in the company to 14.7%. Starting in June, Bassari was then ramped to $0.021.

According to ASIC, this was not a ramp because market manipulation does not exist, and therefore ASIC will do exactly nothing about it. As always. Bassari of course follows the standard pattern of manipulated shares, namely catastrophic long-term shareholder value destruction interspersed with short-term ramps designed to benefit insiders.

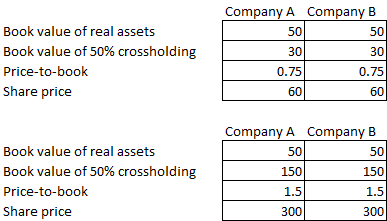

In June, the bellends at Hill End then announced they were selling their gold projects to LionGold Corp Ltd (A78.SI), part of the Blumont investment cartel, naturally with the consideration mainly in the form of LionGold scrip. The Blumont cartel uses crossholdings, revaluations and share ramping beyond NTA to create tremendous synthetic leverage, as first described by this blog post. Assume Company A and Company B each has $50 of real assets and a 50% shareholding in each other. Moving price-to-book from 0.75 to 1.5 quintuples the share price of both companies.

This is yet one more example of the Singapore-based criminal investment cartel making inroads on the Australian "market", while regulators in both countries twiddle themselves. The disastrous losses already suffered by victims of the Blumont cartel lie squarely at the feet of the complicit regulators, as do any further losses created by allowing these criminals to continue operating.

Thursday, 3 July 2014

The Macquarie Atlas Roads Group revaluation fraud

Macquarie Atlas Roads Group (MQA.AX) is an ASX-listed revaluation fraud masquerading as a toll road operator. An investment cartel headed by Macquarie controls the "market" price of MQA, and has ramped the stapled security in order to fraudulently obtain inflated management fees. The top 20 shareholders own 91% of MQA and control its share price. This revaluation fraud is the true purpose of MQA, the real reason for its creation and existence. At heart, MQA is no different from Fifth Element Resources.

Like other such scams, MQA is structured in a Byzantine maze of related parties, crossholdings, loans and sham transactions. MQA's annual report is deliberately deceptive, packed with accounting fraud designed to obscure a very simple business model. MQA's assets generate $49m of cash flows, of which the criminal managers absorb a base fee of $18m. After this 37% fee, the remaining $31m is available for distribution to victim investors. If MQA's share price was not openly controlled by a cartel, it would have collapsed. Instead it was ramped to a $1.6bn market cap, packaged in financial "products" and dumped on granny investors.

As a result of the ramp, the criminal managers entitled themselves to a staggering $58m "performance fee". No magical unicorns or leprechauns need be presumed to explain this straightline ramp. The explanation to this mystery is depressingly simple. A small group of criminals had the power to move the share price, and would benefit handsomely from doing so. So they did.

It is highly likely that the investment cartel that ramped MQA during the past year explicitly discussed their fraud in company emails and on recorded telephone lines, including the exact endpoint of their ramp. Macquarie is a criminal organization that considers itself above the law. But since ASIC operates a zero enforcement policy, this will never be investigated and the criminals will die as free rich men.

Like other such scams, MQA is structured in a Byzantine maze of related parties, crossholdings, loans and sham transactions. MQA's annual report is deliberately deceptive, packed with accounting fraud designed to obscure a very simple business model. MQA's assets generate $49m of cash flows, of which the criminal managers absorb a base fee of $18m. After this 37% fee, the remaining $31m is available for distribution to victim investors. If MQA's share price was not openly controlled by a cartel, it would have collapsed. Instead it was ramped to a $1.6bn market cap, packaged in financial "products" and dumped on granny investors.

As a result of the ramp, the criminal managers entitled themselves to a staggering $58m "performance fee". No magical unicorns or leprechauns need be presumed to explain this straightline ramp. The explanation to this mystery is depressingly simple. A small group of criminals had the power to move the share price, and would benefit handsomely from doing so. So they did.

It is highly likely that the investment cartel that ramped MQA during the past year explicitly discussed their fraud in company emails and on recorded telephone lines, including the exact endpoint of their ramp. Macquarie is a criminal organization that considers itself above the law. But since ASIC operates a zero enforcement policy, this will never be investigated and the criminals will die as free rich men.

Tuesday, 1 July 2014

The Fifth Element Resources Limited revaluation fraud

Fifth Element Resources Limited (FTH.AX) is a newly ASX-listed revaluation fraud masquerading as a gold explorer, as noted by this blog three weeks ago. The share price of FTH is openly manipulated, having been ramped from $0.20 to $2.30 in a month on no news. Prior to the ramp, an insider purchased 20m shares at $0.01 and the company conducted a sham related party capital raising of 20m shares at $0.20.

FTH has not fallen in price a single day of its existence, a track record as "perfect" as that of the Democratic Front for the Reunification of the Fatherland. According to ASIC and the mainstream media, this is not the result of a blatant market manipulation, but rather a marvellous but inexplicable magic market mystery. ASIC does nothing about market manipulation, allowing FTH to continue "trading" and attracting new victims, because according to ASIC market manipulation does not exist.

A revaluation fraud can be based on any type of business, or indeed an empty shell, as the real point of the scam is the manipulation of "market" prices. The purported underlying business is irrelevant. After manipulating purported "market" prices higher, ramped shares can be dumped on granny investors using fund manager associates. Alternatively, the ramped ASX-listed asset can be used to borrow against, with the proceeds then used for further manipulation. Throughout this, the operators and associates of such schemes collect real cash fees based on unrealized paper profits generated by themselves.

The problem for ASIC is that it has allowed this fraud to fester unchecked for decades, the cancer spreading to the point where its removal may not even be possible. It is not that the stock market tail is wagging the dog, the dog has been completely consumed, leaving nothing but a twitching rotting tail. The ASX is not a market with some elements of fraud, it is a fraud with some elements of market. There is no categorical difference between Fifth Element Resources or Intueri Group Limited (IQE.AX) or Veda Group Limited (VED.AX), they are on the same brownscale of fraud.

Most new Australian IPOs are now revaluation frauds, with investment cartels controlling the "market" outcome according to prearranged deals. Most IPOs in Australia are explicitly performed to create a controllable "market" price, not to raise money furthering an actual productive business with utility for society. Such scams commonly have the top 20 shareholders holding 95% of the shares outstanding.

FTH has not fallen in price a single day of its existence, a track record as "perfect" as that of the Democratic Front for the Reunification of the Fatherland. According to ASIC and the mainstream media, this is not the result of a blatant market manipulation, but rather a marvellous but inexplicable magic market mystery. ASIC does nothing about market manipulation, allowing FTH to continue "trading" and attracting new victims, because according to ASIC market manipulation does not exist.

A revaluation fraud can be based on any type of business, or indeed an empty shell, as the real point of the scam is the manipulation of "market" prices. The purported underlying business is irrelevant. After manipulating purported "market" prices higher, ramped shares can be dumped on granny investors using fund manager associates. Alternatively, the ramped ASX-listed asset can be used to borrow against, with the proceeds then used for further manipulation. Throughout this, the operators and associates of such schemes collect real cash fees based on unrealized paper profits generated by themselves.

The problem for ASIC is that it has allowed this fraud to fester unchecked for decades, the cancer spreading to the point where its removal may not even be possible. It is not that the stock market tail is wagging the dog, the dog has been completely consumed, leaving nothing but a twitching rotting tail. The ASX is not a market with some elements of fraud, it is a fraud with some elements of market. There is no categorical difference between Fifth Element Resources or Intueri Group Limited (IQE.AX) or Veda Group Limited (VED.AX), they are on the same brownscale of fraud.

Most new Australian IPOs are now revaluation frauds, with investment cartels controlling the "market" outcome according to prearranged deals. Most IPOs in Australia are explicitly performed to create a controllable "market" price, not to raise money furthering an actual productive business with utility for society. Such scams commonly have the top 20 shareholders holding 95% of the shares outstanding.

Saturday, 28 June 2014

The Independent Investment Research scam

Independent Investment Research Pty Ltd is a new scam backed by the Australian listed investment company cartel and its associates. Having chosen a deliberately misleading and deceptive brand name, the company provides commissioned research reports for listed and unlisted fraud schemes. After paying IIR to pump their scheme, criminals can quote "Independent Investment Research", while burying disclaimers in small print. This obviously sounds better than quoting "Commissioned Investment Research". IIR has intentionally and semantically sidestepped legal requirements to clearly disclose the nature of commissioned reports.

According to the Australian Competition and Consumer Commision (ACCC), it is illegal for businesses to make claims that are "likely to create a false impression". According to ACCC, businesses need to assess the "overall impression" of their claims, and "can't rely on small print and disclaimers as an excuse for a misleading overall message". ACCC has explicitly stated that “manufacturers cannot hide misleading claims in their brand names” in regards to water branding. However, consumer protection does not apply to financial products, the domain of the congenitally tardy ASIC. Due to the regulator's zero enforcement policy, most types of financial crime have effectively been legalized in Australia, including pump-and-dump schemes and price fixing. Ignoring the law, ASIC has unilaterally decided to allow fraud and the perversion of free markets.

IIR is used by various revaluation and pump-and-dump schemes that are so fraudulent they are usually avoided even by the moron mainstream media. These include previously exposed ponzi US Masters Residential Property Fund (URF.AX), revaluation frauds Sunbridge Group Limited (SBB.AX) and Disruptive Investment Group Limited (DVI.AX), as well as the criminal Australian listed investment company cartel. Managed Account Holdings Limited (MGP.AX) is one of the most recent cartel revaluation frauds covered by this "independent" investment research. Cartel member Argo Investments Limited (ARG.AX) recently bought a 9.25% stake in MGP for $0.12 per share. The loss-making MGP was then listed and immediately ramped to $0.25 by ARG and other related parties of MGP. ARG can now claim unrealized profits of 108% on its investment, that it created itself, based on which its criminal directors can charge real cash fees.

http://www.managedaccounts.com.au/Portals/0/Forms/IIR_Report_MGP_May14.pdf

The commissioned cartel research report for MGP mentions "independence" 53 times. Before even admitting to be a commissioned report in small print, "independence" is mentioned 13 times. Later in the Independent Investment Research report, the disclaimers start getting downright humorous. On the last page, IIR reveals it may:

According to the Australian Competition and Consumer Commision (ACCC), it is illegal for businesses to make claims that are "likely to create a false impression". According to ACCC, businesses need to assess the "overall impression" of their claims, and "can't rely on small print and disclaimers as an excuse for a misleading overall message". ACCC has explicitly stated that “manufacturers cannot hide misleading claims in their brand names” in regards to water branding. However, consumer protection does not apply to financial products, the domain of the congenitally tardy ASIC. Due to the regulator's zero enforcement policy, most types of financial crime have effectively been legalized in Australia, including pump-and-dump schemes and price fixing. Ignoring the law, ASIC has unilaterally decided to allow fraud and the perversion of free markets.

IIR is used by various revaluation and pump-and-dump schemes that are so fraudulent they are usually avoided even by the moron mainstream media. These include previously exposed ponzi US Masters Residential Property Fund (URF.AX), revaluation frauds Sunbridge Group Limited (SBB.AX) and Disruptive Investment Group Limited (DVI.AX), as well as the criminal Australian listed investment company cartel. Managed Account Holdings Limited (MGP.AX) is one of the most recent cartel revaluation frauds covered by this "independent" investment research. Cartel member Argo Investments Limited (ARG.AX) recently bought a 9.25% stake in MGP for $0.12 per share. The loss-making MGP was then listed and immediately ramped to $0.25 by ARG and other related parties of MGP. ARG can now claim unrealized profits of 108% on its investment, that it created itself, based on which its criminal directors can charge real cash fees.

http://www.managedaccounts.com.au/Portals/0/Forms/IIR_Report_MGP_May14.pdf

The commissioned cartel research report for MGP mentions "independence" 53 times. Before even admitting to be a commissioned report in small print, "independence" is mentioned 13 times. Later in the Independent Investment Research report, the disclaimers start getting downright humorous. On the last page, IIR reveals it may:

- Receive payment for the report

- Have a direct or indirect interest in recommended securities

- Buy or sell recommended securities

- Effect transactions that are "inconsistent" with its recommendations

- Infect your computer with viruses

Showing true panache, IIR caps this off by huffily proclaiming that its recommendations are "under no circumstances" ever influenced by any of this. Well, OK then.

Friday, 27 June 2014

The Wilson Foundation's "charitable" fraud

The Wilson Foundation marks a new nadir even for the sociopathic criminals running the Wilson Asset Management (WAM.AX) scam. Although the WAM criminals have stolen millions from granny investors through revaluation and accounting fraud, they have now sunk to a new unforgivable low point. In a despicable bid to reach new victims, the WAM criminals are starting a fraudulent "charity" designed to further their self-interest. Fraud is bad enough, but fraud in the name of charity is truly vile.

The Wilson criminals have taken over the defunct Australian Infrastructure Fund Limited (AIX.AX), planning to repurpose it and perform yet another one of their never-ending capital raisings. The key point (as always) is that this will increase funds under management for WAM and its associates. Jimmy Savile engaged in ostensibly "charitable" acts that allowed him access to new victims. In exactly the same way, the WAM sociopaths are attempting to lure new victims to the fraudulent and inflated listed investment company sector, by making claims of "charity".

WAM claims their new scam involves no self-interest, and that no fees will be charged by participants. This is an outright lie. WAM will own a significant stake in the proposed "charitable" fund. Subsequent upward revaluation of the fund will create unrealized profit for WAM, from which the sociopaths will charge real cash fees. The WAM directors stand to personally make millions from their "charity". They conveniently omit to disclose this.

Moreover, money entrusted by gullible victims to the "charitable" fund will increase funds under management of the cartel. Higher funds under management increases the investment cartel's ability to ramp chosen assets, creating yet more unrealized profits to charge fees from. There is absolutely nothing "charitable" about this fraud. If the Wilson sociopaths really wanted to give to charity, they could very easily do so in a way that would not financially benefit themselves. But these sociopaths cannot even understand the concept of charity without self-interest, cannot comprehend selflessness or love. Pity them, for they are not fully human.

How can the Wilson fraudsters even be allowed to use the word "charity" in their scam? Simple. There is no regulation of the word "charity", just as there is no regulation of "investment". A scheme can literally have fees of 100%, and still legally call itself an "investment". Customers of sausage enjoy more consumer protection. To use the word "sausage", there are set limits on how much canine feces the manufacturer can use. But in Australian financial crime, there are no limits and everything is permitted.

The Wilson criminals have taken over the defunct Australian Infrastructure Fund Limited (AIX.AX), planning to repurpose it and perform yet another one of their never-ending capital raisings. The key point (as always) is that this will increase funds under management for WAM and its associates. Jimmy Savile engaged in ostensibly "charitable" acts that allowed him access to new victims. In exactly the same way, the WAM sociopaths are attempting to lure new victims to the fraudulent and inflated listed investment company sector, by making claims of "charity".

WAM claims their new scam involves no self-interest, and that no fees will be charged by participants. This is an outright lie. WAM will own a significant stake in the proposed "charitable" fund. Subsequent upward revaluation of the fund will create unrealized profit for WAM, from which the sociopaths will charge real cash fees. The WAM directors stand to personally make millions from their "charity". They conveniently omit to disclose this.

Moreover, money entrusted by gullible victims to the "charitable" fund will increase funds under management of the cartel. Higher funds under management increases the investment cartel's ability to ramp chosen assets, creating yet more unrealized profits to charge fees from. There is absolutely nothing "charitable" about this fraud. If the Wilson sociopaths really wanted to give to charity, they could very easily do so in a way that would not financially benefit themselves. But these sociopaths cannot even understand the concept of charity without self-interest, cannot comprehend selflessness or love. Pity them, for they are not fully human.

How can the Wilson fraudsters even be allowed to use the word "charity" in their scam? Simple. There is no regulation of the word "charity", just as there is no regulation of "investment". A scheme can literally have fees of 100%, and still legally call itself an "investment". Customers of sausage enjoy more consumer protection. To use the word "sausage", there are set limits on how much canine feces the manufacturer can use. But in Australian financial crime, there are no limits and everything is permitted.

Thursday, 26 June 2014

ClearView Wealth abuses share buybacks to distort market pricing

In theory, share buybacks create value for shareholders by reducing number of shares outstanding and thus increasing cash flows, earnings and dividends per share. Such a theoretical value-adding buyback involves companies buying their shares at the lowest price attainable to achieve a long-term reduction in shares outstanding. In reality, this is almost never the case. "Increased EPS" is instead used a flimsy pretense to justify buybacks that are performed to directly move share prices. As an entirely accepted commonplace occurrence, criminal directors ramp "market" prices on which executive bonuses and options are awarded.

In Australia, companies have predictably taken this to ludicrous lengths. Criminal directors use share buybacks to ramp their price to predetermined and preannounced levels, breaching fiduciary duty by not seeking the lowest price possible. Companies alternate share issuing with share buybacks, with no reduction in shares outstanding achieved, or issue even more shares than they buy back. Companies will even perform share buybacks and share issuance at the same time, unequivocally admitting they are attempting securities fraud. Euphemisms such as "supporting the share" and "capital management" are commonly used for this securities fraud. In one of the most blatant cases of such fraud, ClearView Wealth Limited (CVW.AX) revealed a capital raising and buyback in the very same ASX announcement.

ClearView openly admitted it was going to attempt securities fraud, in a public announcement, and then proceeded to do so. ASIC of course did nothing whatsoever about this, in line with its zero enforcement policy. When companies perform buybacks explicitly to move market prices, due to the directors' "belief" that the share is undervalued, there is absolutely no justification for this in economic theory, it is open fraud. According to standard finance textbooks, what ClearView did is known as "share manipulation".

But how can Australian regulators, financial media and analysts condone companies explicitly admitting the deliberate distortion of market pricing? Simple. The dregulators, presstitutes and analysts simple assume market efficiency, that prices by definition are unramped and fair, and that higher prices thus always are better. According to ASIC, due to market efficiency share prices cannot be ramped, and so ASIC needs take no action when share prices are ramped.

Criminal listed investment companies commonly announce buybacks explicitly to ramp share prices to parity with NTA (or even beyond). Due to costs, the fair going concern value of listed investment vehicles is lower than NTA, and there is zero justification in economic theory for such vehicles to move their share price above their fair market value. Every director that has performed such a share buyback has not only breached their fiduciary duty to shareholders, but has also demonstrably distorted market prices and committed share manipulation.

If companies are allowed to set their own "market" prices with fraudulent buybacks, they no longer can be considered legitimate listed enterprises priced by a market, but are instead correctly referred to as listed securities frauds. The success of a company that sets its own "market" price is not determined by operational performance or fundamentals. Instead, the longevity of such a scam depends solely on the company's continual ability to raise capital to fund its price fixing. A listed company that sets its own "market" price is a ponzi.

Wednesday, 18 June 2014

The Queensland Bauxite Limited pump-and-dump

Queensland Bauxite Limited (QBL.AX) is a pump-and-dump scheme masquerading as a bauxite explorer. This blog first mentioned the QBL pump-and-dump two weeks ago in a post detailing various ramps orchestrated by Wholesale Investors and Proactive Investors. Since then, the cartel has continued roping in victims with ASIC's blessing and complicity, aided by the homunculi of Australian financial media. No matter how openly manipulated a share is, no matter how obviously ramped by criminals, Australian "journalists" are willing to spruik it. There is literally no scheme too fraudulent. On 13 June, The Motley Fool published a despicable "article" pumping the scam, claiming QBL was "set to soar".

http://www.fool.com.au/2014/06/13/queensland-bauxite-ltd-shares-set-to-soar/

The porcine shill who wrote this "article" should be ashamed of himself. At best, he is a complete moron, and at worst he is a criminal associate of pump-and-dumpers. The Queensland Bauxite securities fraud is operated by veteran share manipulators associated with Merlin Diamonds and the mysterious Gleneagle Securities. Before attaching his name to this pump-and-dump scam forever, The Motley Fool shill should have done some basic due diligence. The cartel ramped QBL from $0.010 to $0.059 in a couple of weeks, performing a complex array of leveraged transactions.

http://www.asx.com.au/asxpdf/20140617/pdf/42q89yzhxz0kdj.pdf

On June 18 QBL then collapsed by 58%. This had absolutely nothing to do with a "market" outcome. The price of QBL had been deliberately ramped by a cartel. Small investors got suckered in as an effect of the ramp, but were not the cause of it. Of course, such small investors can expect zero recourse to the law, because ASIC has effectively legalized pump-and-dump schemes and other revaluation frauds in Australia.

The QBL criminals pulled this exact same scam as recently as 2010. Guess Motley Fools have short memories as well as zero accountability. According to ASIC and the Motley Fool, these are just inexplicable magical market mysteries, and not deliberate ramps at all.

http://www.fool.com.au/2014/06/13/queensland-bauxite-ltd-shares-set-to-soar/

The porcine shill who wrote this "article" should be ashamed of himself. At best, he is a complete moron, and at worst he is a criminal associate of pump-and-dumpers. The Queensland Bauxite securities fraud is operated by veteran share manipulators associated with Merlin Diamonds and the mysterious Gleneagle Securities. Before attaching his name to this pump-and-dump scam forever, The Motley Fool shill should have done some basic due diligence. The cartel ramped QBL from $0.010 to $0.059 in a couple of weeks, performing a complex array of leveraged transactions.

http://www.asx.com.au/asxpdf/20140617/pdf/42q89yzhxz0kdj.pdf

On June 18 QBL then collapsed by 58%. This had absolutely nothing to do with a "market" outcome. The price of QBL had been deliberately ramped by a cartel. Small investors got suckered in as an effect of the ramp, but were not the cause of it. Of course, such small investors can expect zero recourse to the law, because ASIC has effectively legalized pump-and-dump schemes and other revaluation frauds in Australia.

The QBL criminals pulled this exact same scam as recently as 2010. Guess Motley Fools have short memories as well as zero accountability. According to ASIC and the Motley Fool, these are just inexplicable magical market mysteries, and not deliberate ramps at all.

Tuesday, 17 June 2014

The AMP Capital China Growth Fund fraud

AMP Capital China Growth Fund (AGF.AX) is an ASX-listed securities fraud masquerading as a Chinese bluechip fund. Using related party intermediaries, AMP has structured this scam so the fund manager absorbs almost all cash flows from held assets, leaving next to nothing for investor victims. Rigging the price of AGF with cartel associates including Select Investment Partners, AMP intermittently ramps AGF to create unrealized "profits". In the standard pattern of manipulated shares, AGF displays long-term catastrophic shareholder value destruction interspersed with ramps engineered to benefit insiders. This has absolutely nothing to do with a "market" outcome.

According to its annual report, AGF collects around $6.8m in dividends from its stock holdings in China A shares, of which it burns $6.4m, mostly as fees to the criminal managers. Given these ongoing costs, the going concern fair value of AGF to a small investor is around 7% of NTA. It is impossible for a director of such a scam to fulfil their fiduciary duty to investors, since this would mandate recommending they go elsewhere and avoid the swindle. Rather than get 7% of cash flows, investors could easily get 100%, and the sociopathic scum running these scams have a fiduciary duty to warn their investor victims about this.

AGF now functions as a listed securities fraud. By buying and then ramping AGF shares, criminal associate Select Investment Partners has created millions in unrealized "profits", fraudulently inflating its management fees and then dumping the deliberately bloated shares on granny investors through various funds. In the last month alone, Select Investment Partners has devoted millions to this fraud.

AMP and Select Investment Partners are perfectly aware of the fraudulence of their scheme. Since they deliberately engage in fraud, AMP and Select Investment Partners are criminal organizations. This is a simple statement of fact.

According to its annual report, AGF collects around $6.8m in dividends from its stock holdings in China A shares, of which it burns $6.4m, mostly as fees to the criminal managers. Given these ongoing costs, the going concern fair value of AGF to a small investor is around 7% of NTA. It is impossible for a director of such a scam to fulfil their fiduciary duty to investors, since this would mandate recommending they go elsewhere and avoid the swindle. Rather than get 7% of cash flows, investors could easily get 100%, and the sociopathic scum running these scams have a fiduciary duty to warn their investor victims about this.

AGF now functions as a listed securities fraud. By buying and then ramping AGF shares, criminal associate Select Investment Partners has created millions in unrealized "profits", fraudulently inflating its management fees and then dumping the deliberately bloated shares on granny investors through various funds. In the last month alone, Select Investment Partners has devoted millions to this fraud.

AMP and Select Investment Partners are perfectly aware of the fraudulence of their scheme. Since they deliberately engage in fraud, AMP and Select Investment Partners are criminal organizations. This is a simple statement of fact.

Morgan Stanley and the Galileo Japan Trust securities fraud

Galileo Japan Trust (GJT.AX) is an ASX-listed revaluation fraud masquerading as a Japanese real estate fund. Purportedly trading at a "market" price, in reality the share price of GJT is fixed by a cartel of fund managers consisting of Morgan Stanley, Macquarie Bank, Deutsche Bank and Allan Gray. After a "recapitalisation", this cartel deliberately ramped the "market" price of GJT, and then dumped the inflated shares on granny investors through various channels.

The criminals took $6m in direct fees from the "recapitalisation". They also charge real cash fees based on the unrealized "profit" they themselves engineered, with ramped GJT used as collateral for further fraud. This is not a matter of conjecture, it is a simple statement of fact. On June 12, Morgan Stanley received 4,791,489 shares of GJT as collateral. In the "recapitalisation", GJT raised money expressly for the purpose of reinstating distributions, since its held "assets" produce no actual cash flows whatsoever. There is a word for this too.

GJT was intentionally ramped until it was included in ASX300 index, allowing the criminals to unload some of the inflated shares on index funds mandated to blindly purchase such scams. This index inclusion fraud is now a common occurrence in Australia. The fund managers that pumped the price of GJT also dumped the shares on unwitting granny investors holding funds or life insurance products manufactured by the cartel. Given the immense arrogance of the criminals and tragicomical ineptitude of the regulators, it is highly likely the fund managers discussed their fraud in emails and recorded telephone conversations. They consider themselves untouchable.

The share price of GJT is openly manipulated by the cartel, to the point no reasonable person could even pretend a "market" determines its pricing. As a listed securities fraud, GJT follows the standard pattern of catastrophic long-term shareholder value destruction interspersed with ramps engineered to benefit insiders. Of course, according to ASIC this is just an inexplicable magical market mystery and not securities fraud at all.

This revaluation fraud is just as criminal as a bag snatching, and there is certainly no moral difference. However, the scammed grannies have zero recourse to the law, since these criminals control the regulators, legal system and media.

The criminals took $6m in direct fees from the "recapitalisation". They also charge real cash fees based on the unrealized "profit" they themselves engineered, with ramped GJT used as collateral for further fraud. This is not a matter of conjecture, it is a simple statement of fact. On June 12, Morgan Stanley received 4,791,489 shares of GJT as collateral. In the "recapitalisation", GJT raised money expressly for the purpose of reinstating distributions, since its held "assets" produce no actual cash flows whatsoever. There is a word for this too.

GJT was intentionally ramped until it was included in ASX300 index, allowing the criminals to unload some of the inflated shares on index funds mandated to blindly purchase such scams. This index inclusion fraud is now a common occurrence in Australia. The fund managers that pumped the price of GJT also dumped the shares on unwitting granny investors holding funds or life insurance products manufactured by the cartel. Given the immense arrogance of the criminals and tragicomical ineptitude of the regulators, it is highly likely the fund managers discussed their fraud in emails and recorded telephone conversations. They consider themselves untouchable.

The share price of GJT is openly manipulated by the cartel, to the point no reasonable person could even pretend a "market" determines its pricing. As a listed securities fraud, GJT follows the standard pattern of catastrophic long-term shareholder value destruction interspersed with ramps engineered to benefit insiders. Of course, according to ASIC this is just an inexplicable magical market mystery and not securities fraud at all.

This revaluation fraud is just as criminal as a bag snatching, and there is certainly no moral difference. However, the scammed grannies have zero recourse to the law, since these criminals control the regulators, legal system and media.

Friday, 13 June 2014

Fund intermediaries and credit creation

If fund intermediaries are allowed to disregard costs and fix their unit price at NTA, this will introduce a systemic source of overvaluation. The ongoing fair value of a fund to a non-controlling investor is equal to the NTA less costs as proportion of asset cash flows. For example, a fund that every year burns 20% of the cashflows generated by its assets has a fair value of 80% of NTA. Funds that set prices above this fair value during times of net investor inflows are deliberately defrauding their investors, as they could not support this price were there sustained net investor outflows. On an aggregate level, such fund intermediaries engage in a completely unregulated and unrecognized credit creation process.

Assume Fund A invests in Asset X, and has management costs equalling 20% of the cash flows generated by this investment each year. Since 80% of the cash flows reach the owners of Fund A, the fair value of the fund would as noted be 80% of NTA. Now assume instead Fund A invests in Fund B that invests in Fund C that invests in Asset X, with each fund manager taking 20% of received cash flows. Since 51% of the cash flows now reach the owners of Fund A, the fair value of Fund A is 51% of NTA. The remaining 49% of cash flows from Asset X are absorbed by the fund managers.

Assume Fund A invests in Asset X, and has management costs equalling 20% of the cash flows generated by this investment each year. Since 80% of the cash flows reach the owners of Fund A, the fair value of the fund would as noted be 80% of NTA. Now assume instead Fund A invests in Fund B that invests in Fund C that invests in Asset X, with each fund manager taking 20% of received cash flows. Since 51% of the cash flows now reach the owners of Fund A, the fair value of Fund A is 51% of NTA. The remaining 49% of cash flows from Asset X are absorbed by the fund managers.

| Fund A | Fund B | Fund C | Asset X | |

| Cashflow to owner | 51% | 64% | 80% | 100% |

| Cashflow to fund manager | 13% | 16% | 20% |

Despite the funds having fair values ranging from 51% to 80% of NTA, all three can fix their price and issue units at NTA, with all three claiming the full right to the same cash flow. In effect, this means the cash flows from Asset X are rehypothecated into 149%, since 100% of the cash flows are promised to investors and 49% absorbed by the fund managers in aggregate.

In aggregate, fund intermediaries and their price-fixing are a form of shadow banking and contribute to the credit creation process, since they create "assets" that can then be used as collateral for lending. In the example above, if Asset X was worth $1bn, the intermediaries have created a further $490m through deliberate fraud, conjuring $490m worth of collateral from thin air into the economy. If all fund intermediaries in an economy fix their unit price at NTA, the aggregate amount of credit creation this entails is equal to aggregate intermediary costs. In Australia, given the high total cost of fund intermediaries, this synthetic leverage has a significant - and entirely ignored - impact on credit creation.

Wednesday, 11 June 2014

Lionhub Group Limited launches new revaluation fraud

International criminals increasingly use the Australian stock exchange to perpetrate revaluation frauds, creating phantom collateral they can borrow against, with the loan proceeds used for further fraud. Most recently, Singaporean criminals backdoor listed LionHub Group Limited (LHB.AX) on the ASX, taking over a dormant shell company in order to create a fake "market" price. After various sham related party transactions and a fraudulent capital raising, LionHub now has 757m shares outstanding and $6.5m cash in the bank. Although LionHub issued less than 5% of shares in the capital raising, the issue price of $0.20 implied a "market" value of $151m for the company.

Magically, the $6.5m in cash has been revalued to a $151m ASX-listed asset, guaranteed by ASIC to be unmanipulated. This fraudulent asset can then be used as collateral for debt, or be dumped on unwitting grannies by associated criminal fund managers. The top 20 shareholders own 95% of LHB, and after reinstatement to listing on June 12 the share price will be controlled by this cartel, creating a fake "market" value.

Shell companies for revaluation frauds are openly marketed in Australia by criminal enterprises such as Wholesale Investors, which also offer to ramp share prices and supply local sham directors and company secretaries. LionHub has connections to Sino Australia Oil & Gas (SAO.AX) and other related party frauds, sharing the same criminal associates. These manipulated frauds follow the standard pattern of long-term shareholder value destruction interspersed with sharp ramps engineered to benefit insiders.

ASIC and media alike regard the fraudulent ramps as magical market mysteries, enigmatic and wonderful occurrences for which there just can be no explanation. New revaluation fraud Fifth Element Resources (FTH.AX) issued 21m shares at $0.20 in a fraudulent capital raising, after which the share price was ramped to $0.95 in a month. Prior to the capital raising and ramp, an insider had purchased 20m shares at $0.01.

According to ASIC, this is not a ramp and FTH is not an openly manipulated share, because if it were ASIC would have done something. According to ASIC, this is all just a magical market mystery, and so ASIC lets it continue trading freely and attract more victims.

Magically, the $6.5m in cash has been revalued to a $151m ASX-listed asset, guaranteed by ASIC to be unmanipulated. This fraudulent asset can then be used as collateral for debt, or be dumped on unwitting grannies by associated criminal fund managers. The top 20 shareholders own 95% of LHB, and after reinstatement to listing on June 12 the share price will be controlled by this cartel, creating a fake "market" value.

Shell companies for revaluation frauds are openly marketed in Australia by criminal enterprises such as Wholesale Investors, which also offer to ramp share prices and supply local sham directors and company secretaries. LionHub has connections to Sino Australia Oil & Gas (SAO.AX) and other related party frauds, sharing the same criminal associates. These manipulated frauds follow the standard pattern of long-term shareholder value destruction interspersed with sharp ramps engineered to benefit insiders.

ASIC and media alike regard the fraudulent ramps as magical market mysteries, enigmatic and wonderful occurrences for which there just can be no explanation. New revaluation fraud Fifth Element Resources (FTH.AX) issued 21m shares at $0.20 in a fraudulent capital raising, after which the share price was ramped to $0.95 in a month. Prior to the capital raising and ramp, an insider had purchased 20m shares at $0.01.

According to ASIC, this is not a ramp and FTH is not an openly manipulated share, because if it were ASIC would have done something. According to ASIC, this is all just a magical market mystery, and so ASIC lets it continue trading freely and attract more victims.

Tuesday, 3 June 2014

Axstra Capital and Wholesale Investors pump-and-dump

Axstra Capital and Wholesale Investors run a pump-and-dump operation and investment cartel, not to be confused with Avestra Capital and Next Investors, artificially inflating the share prices of small caps for a fee. The Wholesale Investors criminals target small investors, using handy relief helpfully provided by the complicit regulator. As a service to criminals, ASIC regularly provides exemptions that produce loopholes and results diametrically opposite to what the law actually intended. The exemption in question removes disclosure requirements for business introduction services, subject to conditions. Names and logos can only be available on subscription, and acknowledgement of disclaimers is required beforehand. However, Wholesale Investors openly flouts these requirements and makes names and logos available straight away, with additional spruiking available on subscription. For example, one of the Austalian [sic] Investment Opportunities spruiked by the cartel is named Westlake Funding Ltd, as can be seen below by non-subscribers.

http://www.wholesaleinvestor.com.au/companies/

The Wholesale Investors website is rife with listed and unlisted securities frauds, with rigged "market" values. The criminals recently took an interest in Qanda Technologies (QNA.AX) and immediately ramped the stock from $0.03 to $0.11. Sharp ramps such as these provide profits for insiders, allows unrealized profits to be booked by fund managers, and increases the value of securities used for further cartel leverage.

In the long term, such manipulated companies inevitably display catastrophic shareholder value destruction. Qanda Technologies illustrates this beautifully, with sequential manufactured ramps interrupting steady decline. This is because QNA is a listed securities fraud.

ASIC protects pump-and-dump cartels instead of protecting the victims, displaying what must now be regarded as treasonous rather than incompetent behaviour. As a result, the Australian share market is now so infested with manipulation it is hard to pinpoint where the fraud ends. By the same token, mainstream financial reporting and pump-and-dump articles are becoming indistinguishable, sometimes written or commissioned by the same criminals. The Wholesale Investors criminals are also associated with the pump-and-dump site Proactive Investors. On 3 June, Queensland Bauxite Limited (QBL.AX) was the subject of a Proactive Investors "article" and 115% share ramp.

According to ASIC these are not ramps but rather magical market mysteries. If fund managers package and dump such ramped shares on granny investors, it is a magical market mystery when the grannies lose all their money. It is not ASIC's fault, since market manipulation does not exist.

http://www.wholesaleinvestor.com.au/companies/

The Wholesale Investors website is rife with listed and unlisted securities frauds, with rigged "market" values. The criminals recently took an interest in Qanda Technologies (QNA.AX) and immediately ramped the stock from $0.03 to $0.11. Sharp ramps such as these provide profits for insiders, allows unrealized profits to be booked by fund managers, and increases the value of securities used for further cartel leverage.

In the long term, such manipulated companies inevitably display catastrophic shareholder value destruction. Qanda Technologies illustrates this beautifully, with sequential manufactured ramps interrupting steady decline. This is because QNA is a listed securities fraud.

ASIC protects pump-and-dump cartels instead of protecting the victims, displaying what must now be regarded as treasonous rather than incompetent behaviour. As a result, the Australian share market is now so infested with manipulation it is hard to pinpoint where the fraud ends. By the same token, mainstream financial reporting and pump-and-dump articles are becoming indistinguishable, sometimes written or commissioned by the same criminals. The Wholesale Investors criminals are also associated with the pump-and-dump site Proactive Investors. On 3 June, Queensland Bauxite Limited (QBL.AX) was the subject of a Proactive Investors "article" and 115% share ramp.

According to ASIC these are not ramps but rather magical market mysteries. If fund managers package and dump such ramped shares on granny investors, it is a magical market mystery when the grannies lose all their money. It is not ASIC's fault, since market manipulation does not exist.

Friday, 30 May 2014

Australian central banker joins Djerriwarrh Investments fraud

Djerriwarrh Investments (DJW.AX) is a criminal listed investment company that uses accounting fraud to inflate its books, including doublecounting upcoming dividends as a receivable, and manipulates its share price beyond asset backing before issuing shares to granny investors. DJW shares are currently ramped 29% beyond the value of the listed holdings that constitute its backing, so an investor buying $10,000 worth of DJW makes an immediate loss of around $2,200, not even taking into account subsequent fees charged. Like other similar scam companies, Djerriwarrh has a mysterious buyback mechanism in place with Goldman Sachs, for "capital management" purposes, that DJW claims to not use at all.

http://www.asx.com.au/asxpdf/20140203/pdf/42mj09h6cvm2xr.pdf

Scam listed investment companies have forged high level connections with regulators, media, analysts, fund managers and the government. The companies sometimes buy respectability by enticing figureheads to join their boards, relying on greed to silence questions and doubts fiduciary duty would mandate. On 29 May Djerriwarrh announced that a board member of the Reserve Bank of Australia had joined as non-executive director, to help with "deliberations" and "governance".

http://www.asx.com.au/asxpdf/20140529/pdf/42px6rv23zdksm.pdf

If this central banker observed her fiduciary duty as director of a company entrusted with other people's money, she would have done her due diligence, studied the annual reports for Djerriwarrh, and realized it is a fraud scheme. DJW is structured so that the average investor almost certainly will lose money, and thus has crossed the line into scam. Joining such a scam can provide a quick revenue stream in the form of director fees, but requires a complete lack of integrity and criminal negligence of fiduciary duty.

http://www.asx.com.au/asxpdf/20140203/pdf/42mj09h6cvm2xr.pdf

Scam listed investment companies have forged high level connections with regulators, media, analysts, fund managers and the government. The companies sometimes buy respectability by enticing figureheads to join their boards, relying on greed to silence questions and doubts fiduciary duty would mandate. On 29 May Djerriwarrh announced that a board member of the Reserve Bank of Australia had joined as non-executive director, to help with "deliberations" and "governance".

http://www.asx.com.au/asxpdf/20140529/pdf/42px6rv23zdksm.pdf

If this central banker observed her fiduciary duty as director of a company entrusted with other people's money, she would have done her due diligence, studied the annual reports for Djerriwarrh, and realized it is a fraud scheme. DJW is structured so that the average investor almost certainly will lose money, and thus has crossed the line into scam. Joining such a scam can provide a quick revenue stream in the form of director fees, but requires a complete lack of integrity and criminal negligence of fiduciary duty.

Friday, 23 May 2014

Avestra's Next Investors pump-and-dump AnaeCo

Avestra Capital runs a pump-and-dump operation, through its corporate authorised representative S3 Consortium Pty Ltd, offering to artificially inflate the price of Australian small cap shares for a fee. The website www.nextinvestors.com spruiks shares the criminals are trying to pump-and-dump, with these deliberately misleading "tips" and "opportunities" spread through spam emails and social media. The website even has a special VIP section for the extremely gullible to self-select. Most recently, Next Investors pump-and-dumped AnaeCo (ANQ.AX), an eternally loss-making trash management company with ties to other elements of the Australian financial underworld.

ANQ follows the standard pattern of manipulated shares, with long term catastrophic shareholder destruction interspersed by ramps designed to benefit insiders. This is because ANQ is a listed securities fraud. On 21 March 2014, the Avestra criminals started the pump-and-dump with a Next Investors article claiming ANQ had miraculously solved the world's waste problems. Global waste crisis solved!

http://www.nexttechstock.com/global-waste-crisis-solved-asx-company-invents-astonishing-technology

Over the next few days the criminals that had commissioned this pump-and-dump could unload their ANQ junk shares at up to 55% higher prices, fleecing the unsuspecting until the engineered ramp inevitably faded. What happened next is as idiotic as any episode of "America's Dumbest Criminals". When queried by the ASX about the mysterious 21 March price increase, the criminals at AnaeCo just had to say they had no idea, using the template provided here. ASIC would have written it off as yet another one of their magical market mysteries. Instead, AnaeCo responded that the price increase could be attributed to a positive article by "Stocks Digital".

But the name "Stocks Digital" is not mentioned anywhere in the article published on Next Investors. The website www.stocksdigital.com offers to "raise awareness of small caps" using "social media and the internet", providing no other information except a number to an Australian mobile phone. By mentioning Stocks Digital, the AnaeCo criminals inadvertently proved they had commissioned the pump-and-dump, and supplied the contact information of the pump-and-dumpers. In May ANQ announced that an ANQ director had lost control of a 163m shareholding, followed by the announcement of his resignation. The share price ramp to $0.013 at the end of the March quarter had artificially inflated the "market" value of the director shareholding used as security for a loan. Just before end of trading on May 23, 163m ANQ shares changed hands at $0.006.

According to ASIC, pump-and-dump schemes are illegal and operators "can be jailed and fined heavily". However, since ASIC never enforces this, ASIC has effectively legalized pump-and-dump schemes in Australia. As a result, such fraud is guaranteed to become more common.

ANQ follows the standard pattern of manipulated shares, with long term catastrophic shareholder destruction interspersed by ramps designed to benefit insiders. This is because ANQ is a listed securities fraud. On 21 March 2014, the Avestra criminals started the pump-and-dump with a Next Investors article claiming ANQ had miraculously solved the world's waste problems. Global waste crisis solved!

http://www.nexttechstock.com/global-waste-crisis-solved-asx-company-invents-astonishing-technology

Over the next few days the criminals that had commissioned this pump-and-dump could unload their ANQ junk shares at up to 55% higher prices, fleecing the unsuspecting until the engineered ramp inevitably faded. What happened next is as idiotic as any episode of "America's Dumbest Criminals". When queried by the ASX about the mysterious 21 March price increase, the criminals at AnaeCo just had to say they had no idea, using the template provided here. ASIC would have written it off as yet another one of their magical market mysteries. Instead, AnaeCo responded that the price increase could be attributed to a positive article by "Stocks Digital".

According to ASIC, pump-and-dump schemes are illegal and operators "can be jailed and fined heavily". However, since ASIC never enforces this, ASIC has effectively legalized pump-and-dump schemes in Australia. As a result, such fraud is guaranteed to become more common.

Tuesday, 20 May 2014

Google Australia censorship

Google Australia has removed several posts from this blog, at the behest of the criminals whose securities fraud are exposed within. People in China and Russia are free to read these posts if they wish, and make their own mind up, but Australians are not allowed to. In Australia, criminals decide what information you are allowed to access. This is for your own good. However, Australian readers of this blog can bypass this censorship by adding /ncr to the blog address, with the full uncensored version of The Great Australian Investment Ponzi available here:

http://drbenway.blogspot.com/ncr

The removed posts can be accessed by Australian readers by following these links:

http://drbenway.blogspot.com/ncr/2014/04/conman-michael-

http://drbenway.blogspot.com/ncr/2014/01/avestra-hires-self-confessed-criminal.html

http://drbenway.blogspot.com/ncr/2013/12/aha-avestra-and-formosa-auto-trade-scam.html

The Chilling Effects clearinghouse still has not processed the takedown requests in relation to these posts. Perhaps this information is taboo too. If you are a rich criminal, the Australian system works great, as it allows you to hide your crimes using legal threats. After all, who has better access to lawyers, rich criminals or whistleblowers? According to Google's transparency report, in the first six months of 2013, the Australian government made 19 requests for content removal, of which 4 were for defamation on Blogger.

http://www.google.com/transparencyreport/removals/government/AU/

With recent judgments against Google in Australia and in the EU, the censorship situation is likely to deteriorate worldwide. The effect of this is easy to predict. Information that is true and in the public interest will be suppressed by those with the means to do so.

http://drbenway.blogspot.com/ncr

The removed posts can be accessed by Australian readers by following these links:

http://drbenway.blogspot.com/ncr/2014/04/conman-michael-

http://drbenway.blogspot.com/ncr/2014/01/avestra-hires-self-confessed-criminal.html

http://drbenway.blogspot.com/ncr/2013/12/aha-avestra-and-formosa-auto-trade-scam.html

The Chilling Effects clearinghouse still has not processed the takedown requests in relation to these posts. Perhaps this information is taboo too. If you are a rich criminal, the Australian system works great, as it allows you to hide your crimes using legal threats. After all, who has better access to lawyers, rich criminals or whistleblowers? According to Google's transparency report, in the first six months of 2013, the Australian government made 19 requests for content removal, of which 4 were for defamation on Blogger.

http://www.google.com/transparencyreport/removals/government/AU/

Sunday, 18 May 2014

AIMS Property Securities Fund circular investment fraud

AIMS Property Securities Fund (APW.AX), formerly MacarthurCook Property Securities, is a loss-making property fund flagrantly committing fraud by making circular "investments" with related funds. Dual listed on the ASX and SGX, the fund holds a purported $37m in unlisted property funds that it values at will, and a further $18m in listed property funds. The fund consistently burns around half the cash generated by its assets, and so given these ongoing costs its fair value to a non-controlling investor would be around 50% of NTA. If APW truly traded in a free market, where a multitude of buyers and sellers made transactions without the intention or ability to affect the price, it would trade at 50% of NTA. The criminal operators of this fund has attempted to ramp the price up towards NTA with buybacks and related party purchases. So naturally, APW follows the familiar pattern of long-term shareholder value destruction interspersed with sharp ramps to benefit insiders.

The latest half-yearly report for APW shows how the fund has "invested" $3.5m in the related MacarthurCook Office Property Trust. The report also discloses how the MacarthurCook Office Property Trust has "invested" $2.5m in APW. Because of this circular "investing", these related funds report NTAs fraudulently inflated by several million dollars, with this fraud constituting a significant proportion of their reported assets. This circular investment charade is criminal, regardless of regulator incompetence. APW also holds 49.9% of AIMS Property Fund (St Kilda Road), while related party AIMS Capital Management Limited holds 27.8% of APW. Seen as a whole, APW is a criminal enterprise, a circular investment scam that plans to issue units to victim investors based on a purposefully inflated balance sheet and performance.

AIMS Property Securities Fraud recently won a long running lawsuit against P-REIT (PXT.AX), currently managed by equally criminal BlackWall Property Fund. Just like APW, BlackWall funds circularly "invest" in each other and perform accounting fraud, as seen in the latest PXT half-yearly report. The lawsuit related to rights of withdrawal and redemption, as APW had been issued units with the promise of par redemption. With the judgment for $15.4m plus costs, one set of criminal managers has been ordered to hand over shareholder funds to another set of criminal managers. There were no small shareholder winners.

Wednesday, 14 May 2014

The Australian Foundation Investment Company share fix

The Australian Foundation Investment Company (AFI.AX) is a criminal listed investment company that engages in accounting fraud and share manipulation. AFI cooks its books with related party crossholdings, ramped illiquid assets and doublecounted dividends receivables. The AFI cartel ramps its share price above asset backing before issuing shares, in one of the most flagrant cases of Australian securities fraud. The fund currently has a "market" price set by the criminals at 19% above asset backing, with this price of course only sustainable as long as investors do not actually try to cash out. An investor purchasing $10,000 worth of newly issued AFI shares makes an immediate 16% loss, receiving an asset backed by $8,400 and paying a hidden $1,600 fee to the scheme operators, not even taking into account subsequent fees. This is not an investment, it is an outright scam.

Recently, the entities that fix AFI's price curiously have abandoned any semblance of "market" pricing. Starting in March 2014, the AFI share price plateaued in a way that is overtly inconsistent with market pricing, openly proving it is manipulated. Between 11/03/14 and 11/04/14, AFI closed at $6.00 plus/minus $0.02 on 21 out of 24 trading days. Even more curiously, between 14/04/14 and 7/05/14, AFI closed at $5.96 plus/minus $0.01 on 14 out of 15 trading days. This "liquid" $6.2bn listed company closed within 0.17% on eleven days straight, a near statistical impossibility in an unmanipulated market. Only a moron would pretend this has anything to do with market pricing or that AFI's share price is not fixed.

Australian presstitutes, analysts and dregulators simply pretend as if this did not happen.

Recently, the entities that fix AFI's price curiously have abandoned any semblance of "market" pricing. Starting in March 2014, the AFI share price plateaued in a way that is overtly inconsistent with market pricing, openly proving it is manipulated. Between 11/03/14 and 11/04/14, AFI closed at $6.00 plus/minus $0.02 on 21 out of 24 trading days. Even more curiously, between 14/04/14 and 7/05/14, AFI closed at $5.96 plus/minus $0.01 on 14 out of 15 trading days. This "liquid" $6.2bn listed company closed within 0.17% on eleven days straight, a near statistical impossibility in an unmanipulated market. Only a moron would pretend this has anything to do with market pricing or that AFI's share price is not fixed.

Australian presstitutes, analysts and dregulators simply pretend as if this did not happen.

Australian Unity funds fraudulently misrepresent fees

Australian Unity Limited (AYU.AX) is a fund manager engaged in related party fraud, with its various funds "investing" in each other. By using internal crossholdings, Australian Unity charges management fees many times in excess what it discloses in Product Disclosure Statements, and inflates the asset base upon which it issues units. This is deliberate fraud.

Page 6 of the Product Disclosure Statement of the Australian Unity Pro-D Balanced Fund, reports (negotiable) management fees of 0.65%. However, Australian Unity siphons money from Pro-D into various other related party funds, charging management fees several times over as part-owner of "investment partners" including Acorn Capital. This fraud allows Australian Unity to charge fees many times higher than it discloses, and inflates the fund's asset base. The magical get-out-of-jail card Australian Unity relies on is tucked into the last page of the PDS, where it says "The fund may also invest in other Australian Unity Investments managed funds".

Of course such a clause in no way frees the criminal directors from their fiduciary duty. Their related party "investing" is illegal, regardless of the clause. Nor can the clause be used to justify underreporting the fees charged. If such a clause could legally be used to hide fees, then all funds could report zero fees in disclosure documents, while having a centipede of intermediaries charge undisclosed fees. The clause is not lawful as it would invalidate the entire disclosure regiment. There would be no point in fee disclosure if such a clause could be used. But as long as ASIC protects the Australian Unity criminals, they can underreport the fees of their funds using fraudulent PDS.

Acorn Capital recently launched a listed investment company to join the circular investment cartel. The Acorn Capital Investment Fund Limited (ACQ.AX) charges 1% of assets plus a performance fee. Naturally, the criminals immediately siphoned money from Australian Unity funds into this new fee-charging intermediary, including money from the Pro-D Balanced Fund. This was a deliberate act of fraud.

Page 6 of the Product Disclosure Statement of the Australian Unity Pro-D Balanced Fund, reports (negotiable) management fees of 0.65%. However, Australian Unity siphons money from Pro-D into various other related party funds, charging management fees several times over as part-owner of "investment partners" including Acorn Capital. This fraud allows Australian Unity to charge fees many times higher than it discloses, and inflates the fund's asset base. The magical get-out-of-jail card Australian Unity relies on is tucked into the last page of the PDS, where it says "The fund may also invest in other Australian Unity Investments managed funds".

Of course such a clause in no way frees the criminal directors from their fiduciary duty. Their related party "investing" is illegal, regardless of the clause. Nor can the clause be used to justify underreporting the fees charged. If such a clause could legally be used to hide fees, then all funds could report zero fees in disclosure documents, while having a centipede of intermediaries charge undisclosed fees. The clause is not lawful as it would invalidate the entire disclosure regiment. There would be no point in fee disclosure if such a clause could be used. But as long as ASIC protects the Australian Unity criminals, they can underreport the fees of their funds using fraudulent PDS.

Acorn Capital recently launched a listed investment company to join the circular investment cartel. The Acorn Capital Investment Fund Limited (ACQ.AX) charges 1% of assets plus a performance fee. Naturally, the criminals immediately siphoned money from Australian Unity funds into this new fee-charging intermediary, including money from the Pro-D Balanced Fund. This was a deliberate act of fraud.

Wednesday, 7 May 2014

Blue Sky Alternative Investments related party fraud

Blue Sky Alternative Investments Limited (BLA.AX) is a relatively new related party fraud masquerading as a fund manager. Operating a number of "alternative" funds with assets largely revalued at will, Blue Sky "co-invests" shareholder capital in these related parties, paying management fees to itself. Blue Sky and its funds perform internal sham transactions to generate fake profits and assets. The criminals then attract new victim investors using fraudulently manufactured performance metrics. The annual reports of Blue Sky are a maze of related party transactions and interests, with gross accounting fraud rendering them next to useless for an investor. Like other circular investment scams, Blue Sky's balance sheet is bloated by related party crossholdings, loans, intangibles and receivables. The company's net profit is inflated by sham transactions and revaluations that have become increasingly farcical.

In the 2012 financial year the company used accounting fraud to inflate its net profit by $4m, with fraud constituting more than four fifths of reported profit. According to its annual report, in June 2012 Blue Sky bought the Lightsview Re-water Infrastructure Network business for $1, creating a magical $2.1m "profit". Blue Sky also bought and revalued Blue Sky Water Partner Pty during the year, creating a $1.7m "profit" from the sham related party transaction.

In the 2013 financial year revaluations boosted the company's reported net profit by 0.9m. Blue Sky "sold" Lightsview to Water Utilities Australia (WUA), an entity set up by Blue Sky itself, for $1,375,000 in cash and $1,375,000 in WUA stapled securities. This resulted in a fake "profit" of $0.6m for Blue Sky and the creation of $4.1m in goodwill. Blue Sky then increased its holdings in WUA by $5m, and gouged the entity with fees paid in scrip.

In its half yearly report to December 2013, Blue Sky reported the "acquisition" of Blue Sky RAMS Management Income Fund, Willunga Basin Water Company and Water Utilities Australia Fund 2. Equity accounting and revaluation of these acquisitions created $12m goodwill and $10m other intangibles. Blue Sky reported half yearly "revenues" of $8.2m, mostly from related parties in which Blue Sky "invests", and a net loss of $1.2m. This loss-making fraudulent mess of a company was then ramped to a $135m market cap, creating unrealized profits for criminal fund associate and substantial holder Pie Funds Management Limited.

In its latest quarterly report to March 2014, Blue Sky reports "lending" $2.4m to a director related entity. The Blue Sky criminals are planning to expand the circular investment cartel, putting $5m in Blue Sky Water Fund and $1m in Blue Sky Apeiron Global Macro B Trust. Blue Sky is also launching a listed investment company, complete with "bonus options", in yet another attempt to fleece granny investors. The LIC structure offers unique advantages to criminals, since LICs are permitted to issue shares at above asset backing, but have no obligation to buy back shares at any price.

In the 2012 financial year the company used accounting fraud to inflate its net profit by $4m, with fraud constituting more than four fifths of reported profit. According to its annual report, in June 2012 Blue Sky bought the Lightsview Re-water Infrastructure Network business for $1, creating a magical $2.1m "profit". Blue Sky also bought and revalued Blue Sky Water Partner Pty during the year, creating a $1.7m "profit" from the sham related party transaction.

In the 2013 financial year revaluations boosted the company's reported net profit by 0.9m. Blue Sky "sold" Lightsview to Water Utilities Australia (WUA), an entity set up by Blue Sky itself, for $1,375,000 in cash and $1,375,000 in WUA stapled securities. This resulted in a fake "profit" of $0.6m for Blue Sky and the creation of $4.1m in goodwill. Blue Sky then increased its holdings in WUA by $5m, and gouged the entity with fees paid in scrip.

In its half yearly report to December 2013, Blue Sky reported the "acquisition" of Blue Sky RAMS Management Income Fund, Willunga Basin Water Company and Water Utilities Australia Fund 2. Equity accounting and revaluation of these acquisitions created $12m goodwill and $10m other intangibles. Blue Sky reported half yearly "revenues" of $8.2m, mostly from related parties in which Blue Sky "invests", and a net loss of $1.2m. This loss-making fraudulent mess of a company was then ramped to a $135m market cap, creating unrealized profits for criminal fund associate and substantial holder Pie Funds Management Limited.

In its latest quarterly report to March 2014, Blue Sky reports "lending" $2.4m to a director related entity. The Blue Sky criminals are planning to expand the circular investment cartel, putting $5m in Blue Sky Water Fund and $1m in Blue Sky Apeiron Global Macro B Trust. Blue Sky is also launching a listed investment company, complete with "bonus options", in yet another attempt to fleece granny investors. The LIC structure offers unique advantages to criminals, since LICs are permitted to issue shares at above asset backing, but have no obligation to buy back shares at any price.

Tuesday, 29 April 2014

Steamships Trading Company and NASFUND securities fraud

Steamships Trading Company (SST.AX) is a $1.1bn company incorporated in Papua New Guinea, claiming operations in "hotel management, manufacturing, property, shipping and transport". In reality, SST is a securities fraud that inflates its accounts using sham transactions between related parties, with a share price fixed by a cartel of three entities.

SST's annual report is a maze of related party transactions and assets. SST's balance sheet shows $13m invested in related companies, $42m in loans to related companies, $29m of "other receivables" and $38m of goodwill. SST added $28m of goodwill to the balance sheet in 2013 by purchasing related party Pacific Towing Limited. This sham transaction created a "profit" of $15m, constituting almost a third of the company's reported net profit of $48m in 2013. The annual report of SST is sufficiently fraudulent that it is next to impossible to gauge the company's true value.

But the true value of SST is almost certainly lower than its manipulated "market" value. SST's share price is not determined by a market. According to disclosure documents, three entities own 98% of SST and have done so for the last decade. John Swire & Sons owns 72%, Bell Potter Nominees fronts 20%, and National Superannuation Fund holds 6%. So far in 2014, SST has traded on 35 days, with an average daily volume below 500 shares. For the last decade the share price of this $1.1bn market cap company has been set by cartel, and not even the most mentally impaired regulator could pretend otherwise with a straight face. Ramped 13% overnight on 2 January 2014, SST functions as a listed securities fraud.

National Superannuation Fund (NASFUND) is a PNG-based superannuation provider that has been embroiled in scandal after scandal, engaging in various revaluation and related party frauds. NASFUND's stake in SST has been revalued upward over the last decade, creating unrealized profits for the fund, based upon which its criminal operators charge real cash fees. The NASFUND criminals pretend SST trades at a market price when reporting performance and asset figures for the fund, while being perfectly aware that SST does not trade at a market price at all. This is deliberate fraud, perpetrated on the 174,000 victims of the fund. NASFUND's inflated $69m stake in SST accounts for a significant proportion of the fund's assets. The SST scam alone accounts for 5% of the fund's net asset value, or around 12% of its listed equities. As long as contributions exceed withdrawals, the fund can continue inflating its accounts with SST.

SST's annual report is a maze of related party transactions and assets. SST's balance sheet shows $13m invested in related companies, $42m in loans to related companies, $29m of "other receivables" and $38m of goodwill. SST added $28m of goodwill to the balance sheet in 2013 by purchasing related party Pacific Towing Limited. This sham transaction created a "profit" of $15m, constituting almost a third of the company's reported net profit of $48m in 2013. The annual report of SST is sufficiently fraudulent that it is next to impossible to gauge the company's true value.