After burning through millions in shareholder funds, the Hill End Gold criminals were seemingly approaching the end of the line, with ASX querying the company's ability to continue operating. As part of its response, Hill End Gold cited a "liquid" holding in related party Bassari Resources Limited (BSR.AX). In March, Hill End Gold had announced it was increasing its stake in related party Bassari by converting a loan at $0.008, bringing its total holding in the company to 14.7%. Starting in June, Bassari was then ramped to $0.021.

According to ASIC, this was not a ramp because market manipulation does not exist, and therefore ASIC will do exactly nothing about it. As always. Bassari of course follows the standard pattern of manipulated shares, namely catastrophic long-term shareholder value destruction interspersed with short-term ramps designed to benefit insiders.

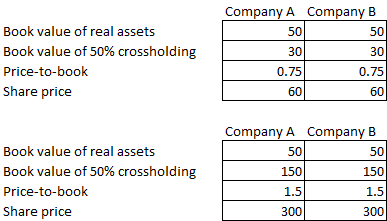

In June, the bellends at Hill End then announced they were selling their gold projects to LionGold Corp Ltd (A78.SI), part of the Blumont investment cartel, naturally with the consideration mainly in the form of LionGold scrip. The Blumont cartel uses crossholdings, revaluations and share ramping beyond NTA to create tremendous synthetic leverage, as first described by this blog post. Assume Company A and Company B each has $50 of real assets and a 50% shareholding in each other. Moving price-to-book from 0.75 to 1.5 quintuples the share price of both companies.

This is yet one more example of the Singapore-based criminal investment cartel making inroads on the Australian "market", while regulators in both countries twiddle themselves. The disastrous losses already suffered by victims of the Blumont cartel lie squarely at the feet of the complicit regulators, as do any further losses created by allowing these criminals to continue operating.

Nice work. I had noticed that HEG was selling its 'assets' Liongold, though I couldn't work out why Liongold would want to buy them, since they're basically worthless.

ReplyDeleteHEG should have been delisted long ago. At least then it would have been unable to 'recapitalise', and would have been wound up.

Total fraud.

Yeah exactly! These frauds should not even exist, and indeed would not exist in a properly regulated and informed market. As a ZH contributor once wrote, the most apt description of such a scam is an "attractive nuisance".

Delete“Like other manipulated shares, Hill End Gold features long-term shareholder value destruction interrupted by sharp manufactured ramps designed to benefit insiders.” “Starting in June, Bassari was then ramped to $0.021.”

ReplyDeleteIf you wanted to ramp the sp of HEG which is a small very illiquid stock, would you do it by trying to push the price of a more liquid stock like BSR which HEG only has a small holding in, or would you do it by buying HEG shares to pump its own price directly and get traders to think something is happening enticing them to jump in?

I could have bought just $3,000 worth of HEG today to push the price up to 0.7 or a rise of 40%. I could have doubled the sp with an at limit order of just $10,000.

Why would anyone spend hundreds of thousands of dollars PER DAY over THREE WEEKS buying up BSR to try and ramp the value of HEG?

What was the net effect on HEG shares of all those dollars spent ramping up BSR? HEG had closing prices of 0.4 to 0.5 on most days over the last 3 months. What’s the price now after BSR was supposedly ramped up? Still 0.5c! Total result is no ramp in the price of HEG. Might as well spend that $3,000 and push HEG up 40% in one inexpensive trade. Wouldn’t that have been easier?

What you say about BSR being ramped for the benefit of HEG insiders, is rubbish. It’s ridiculous, with no evidence at all that it has happened or that the price rise in BSR has helped HEG significantly.

How about Bassari’s sp rose strongly because it released a very positive Feasibility study showing a Net Present Value well above the current market cap of BSR?

I'm saying that both BSR and HEG are manipulated, by the same group, and the historical sharp sudden ramps of these companies are done for the benefit of the investment cartels igniting the ramps. When investment cartels manipulate a portfolio of companies, they use crossholdings between the companies to create synthetic leverage and inflate the balance sheets. This has been covered in length here.

DeleteRampers need spend but a fraction of daily trading turnover to effect sharp share price movements, especially if using leverage. There are plenty of morons willing to buy any "story" and jump aboard a manufactured ramp, as you attest. But these ramps are now commonly performed without any "story" justification, or even after unequivocally negative news. This disproves childishly naive or deliberately disingenuous assertions about "market" pricing.

Read the blog and make a good effort attempt at comprehending its content before you troll here again. It might be more effective.

I'm not trolling at all. I am a shareholder of BSR and I like the story. I bought recently because of the FS results and the assets after extensively researching. I have analysed gold stocks for more than 10 years so I do know something about gold projects. In my opinion, significant buying by investors such as myself immediately following the FS is far more likely to have been the reason for the rally than ramping. Not all price rises are caused by ramping. Most companies share prices grow or fall with the business and often in bursts due to certain catalysts. How about showing good evidence to back up your claim that BSR sp has been ramped. I disagree and that's why I replied. I'm no troll. Do you know anything about the potential value of the project which would indicate the price rise is not due to legitimate buyer interst?

DeleteOK fair enough. Here's the thing: it is almost inconceivable that the LionGold cartel would get involved with HEG without also screwing with BSR, and involved in its latest oh-so-serendipitous capital raising. And if a stock is manipulated, it is almost certainly overvalued and the "story" is irrelevant. It really is that simple. If a company is the plaything of criminals such as the Blumont/LionGold cartel, you should avoid it, no matter how convincing the "story".

DeleteThanks but if these guys are going to ramp BSR to in excess of what it’s worth, then I would prefer to hang around for a big run up in the share price. As I said I have plenty of history with gold stocks and my base case target for this one on an expected diluted basis is at least 4c based only on the indicated part of their resource (170koz of the 1mill oz jorc resource). With its very strong potential to add ounces to the mine plan- especially from a larger zone outside of the jorc zone, it is easy to imagine the market valuing this at 6c with time. If there is some cartel interested in ramping BSR beyond what it’s worth then I might see my target prices achieved sooner rather than later. I won't sell early because of the possibility that some cartel wants to ramp it beyond fair value. I will be happy to sell to them at 8c or higher- unless the company first triples or quadruples ounces in the mine plan. Assuming of course that you are right that this cartel has that intention.

DeleteLOL. It's not that they're going to ramp the price, they already did.

DeleteIf you buy into a scam that you realize is rigged, hoping it will be ramped even further, you deserve to lose everything. But I still wish you the best of luck.

Thanks, I'll take your good luck wishes, but not all stocks are a scam.

DeleteTake a look at the assets before deciding its been ramped beyond fair value. I can see plenty that fit that bill but this one does not.

Probably discussed far enough because it seems you are not interested in what the asset might actually be worth and sounds like you have no interest in researching the company or even looking at the feasibility study which I'm guessing you've already decided also must be part of the scam. If that's the case, debating further is a waste of time. Central Scrutinizer; as for their toasting me taking their stock, I am sitting on better than 100% profit in a few weeks. Maybe I should be the one toasting them?

I'll add that I have no problem with your general argument that manipulation and ramping are widespread. I fully agree. My argument is that it is not the only explanation for a rising share price and I believe your statement that BSR was ramped after the FS was released in June is unsubstantiated and inacurate.

ReplyDeleteHa Ha Ha....

ReplyDeleteBSR - Negative earnings, negative return on equity, an almost sevenfold increase in outstanding shares since inception in 2008 and a non executive director by the name of Philip Bruce, no doubt the one and the same Philip Bruce fleecing 'sophisticated investors' through HEG for years. Only one significant shareholder listed, being HEGL! Acorn Capital sold out, probably to you Chuk!

Sounds legit.

Acorn Capital rings a bell Dr, are they one those totally legit investment companies you've featured previously?

ReplyDeleteTIGA Trading Pty Ltd & Thorney Holdings Pty Ltd were the other shareholders who offloaded everything.

Indeed you are correct, Central Scrutinizer. Acorn Capital and Australian Unity operate a circular investment scam, manufacturing unrealized profits. It's a small world of Australian fraud, the same names popping up again and again.

DeleteClassic! A quick browse through your archives leads to Thorney Opportunities! The Commsec website doesn't give the date or price that these totally legit investment companies offloaded their BSR stock, but I'm figuring they're raising champagne glasses to you Chuk!

ReplyDeleteJesus man, I hope you take the cautious approach to investing.

Central Scrutinizer, as I said above, I am sitting on better than 100% profit in a few weeks. Maybe I should be the one toasting "them". I've been full time trading for around 12 years. I know how to look after myself.

DeleteSitting on 100% profit Chuk is not the $ in your bank account. Until you sell, there's no boasting or toasting.

DeleteAcorn sold, so did Thorney, probably to you. What did you buy BSR for Chuk? It's ok, you can tell us, it's all anonymous.

"Acorn sold, so did Thorney, probably to you."

DeleteHow do you know they sold at all and how could you possibly know they sold to me?

Most of my purchase was at 0.9c and 1.1c. Not that you should care about that and I wasn't boasting. I was replying to an immature comment about how some seller was supposedly toasting me.

Hey Dr, I can't find it in your archives but I seem to remember an article regarding Alcyone (AYN) & some scam involving a clapped out US silver mine.

ReplyDeleteDoesn't look like this one paid off. Alcyone has gone bidless, & suspended its shares due to the fact that it's bust. Even after serial capital raisings & big promises with its Twin Hills 'asset', I don't think any of its 'sophisticated investors' received a single dividend.

I've got BSR on my watchlist. I'll update you on any interesting developments.

Again your memory serves you well, CS. The post was about Platinum Partners, a hedge fund that has aided the Blumont cartel's circular investment schemes.

Deletehttp://drbenway.blogspot.com/2014/02/platinum-partners-limited-launches-new.html

And here we go again! BSR with yet another 'rights offer'. If successful, outstanding shares will be closing in on one billion.

ReplyDeleteWatch this space.

BSR has announced a shortfall of 201,747,529 out of 229,568,229 shares available under its rights issue.

ReplyDeleteThat's obviously some great "market" confidence right there, CS!

Delete