ZipTel Limited (ZIP.AX) is a revaluation fraud currently masquerading as a lossmaking telecom minnow. Backdoor listed on the ASX in July 2014. the entity previously operated as a lossmaking mineral exploration company, and before that as a lossmaking sportswear company. According to its annual report, ZipTel had $556K in turnover and a $3m loss in the 2014 financial year. Whatever. As a revaluation fraud, operational performance is utterly irrelevant to Ziptel. The primary purpose of ZipTel is to provide a manipulable "market" price, which can be ramped for the benefit of insiders. Since listing, manipulating ZIP has created unrealized profits of around $18m for the investment cartel setting its price.

In July 2014, ZipTel raised $5m at $0.20 per share from an investment cartel including K2 Asset Management. In October 2014, ZipTel was shilled on a notorious pump-and-dump website affiliated with the criminal organization of which Michael Featherstone is a part. The investment cartel then ramped ZIP to $0.45, deliberately manufacturing millions in unrealized paper profits. The criminal operators of K2 Asset Management charge real cash fees based on such fraudulently engineered unrealized "profit". This planned fraud was the purpose of listing ZipTel in the very first place.

According to ASIC, this is not a ramp but a magical market mystery, an amazing coincidence for which there just can be no explanation. Investors just happened to rush in at that moment, the investment cartel led by K2 just got amazingly lucky, and no market manipulation occurred. If you are stupid enough to believe such a preposterous stance, you should invest with the next Nigerian prince that contacts you with a great opportunity.

The ZipTel ramp was sufficiently obvious as to constitute prima facie evidence of market manipulation. In a functioning market, regulators would immediately start investigating this blatant fraud, analysts would publicly deride it, newspaper articles would express outrage over this flagrant scam attempt. In a functioning market, the ramp would never even have taken place. But Australia does not have a functioning market, because every component of a working market has been removed. The media and analysts that in a functioning market are tasked to expose such fraud are either owned or controlled by the criminals. The regulator is a sick treasonous joke, only concerned with covering the tracks of the criminal community of which it has become an integral part.

Blog outlining massive fraud in the Australian listed investment company (LIC) and broader financial sector

Tuesday, 25 November 2014

Saturday, 22 November 2014

TTG Fintech and Investorlink $1.4bn securities fraud

TTG Fintech Limited (TUP.AX) is a $1.4bn revaluation fraud masquerading as payments clearing business. TTG listed 4m CDIs at $0.60 on the ASX in late 2012, using the services of Investorlink Securities, a company which specializes in intermediating international securities fraud. The purpose of this listing was not to raise capital for a business, and the share was never intended to be truly priced by a market. On listing the top 20 shareholders held 95% of the 635m CDIs on issue and a cartel controlled the price. The purpose of listing TTG on the ASX was to create a listed security with a manipulable "market" price set by a cartel but legitimized by ASIC. Purchasing an ASX listing "adds credibility", as openly admitted by the criminals themselves. The inflated shares can be used collateral for loans, or included in scam funds for unrealized fake "profits". Some are directly sold to small investors.

According to its FY2014 annual report, TTG Fintech had turnover of RMB0.8m in FY2014 and RMB16m in losses, which at current exchange rates corresponds to a $160K turnover and $3m loss. In the 2013 financial year TTG reported a $3.4m loss on a $210K turnover. But this is irrelevant to TTG's true purpose as a revaluation fraud. The investment cartel initially gave TTG a ridiculous $642m "market" cap and then ramped the share to its current ludicrous $1.4bn "market" cap, with these numbers guaranteed by Australian regulators to be unmanipulated. For sure, it is not ASIC's role to take action against poor shares (a straw man argument the dregulator trots out with wearying predictability). It is, however, ASIC's duty to take action against manipulated shares.

It has become common practice for market manipulating criminals such as TTG and Investorlink to issue shares at headline prices to insider associates, in flimsy attempts to justify ramped prices. The criminal insiders are first quietly issued a large amount of shares at a low price. Later and in conjunction with share ramps, the insiders are issued few shares at a higher price in a publicized sham capital raising. This higher HEADLINE price and ramp is used to attract victims, while the criminals' actual weighted cost of shares is much lower. The most blatant recent case of this market manipulation was the Panorama Synergy scam, where criminals first were issued 347m shares at $0.003, later buying 20m shares at a $0.36 in a sham capital raising designed to provide justification for a ramp. In the case of TTG, the company issued 1m CDIs at $3.05 in July 2014, to provide justification for an openly manipulated "market" price. The shares were issued to a third party comically described as "unrelated to TTG, its Directors or any substantial shareholder".

According to ASIC, this is not a ramp and a revaluation fraud but rather a magical market mystery, a fantastic occurrence for which a logical explanation just cannot be found. ASIC and the ASX have approved TTG and given their guarantee it is not a manipulated securities fraud.

According to its FY2014 annual report, TTG Fintech had turnover of RMB0.8m in FY2014 and RMB16m in losses, which at current exchange rates corresponds to a $160K turnover and $3m loss. In the 2013 financial year TTG reported a $3.4m loss on a $210K turnover. But this is irrelevant to TTG's true purpose as a revaluation fraud. The investment cartel initially gave TTG a ridiculous $642m "market" cap and then ramped the share to its current ludicrous $1.4bn "market" cap, with these numbers guaranteed by Australian regulators to be unmanipulated. For sure, it is not ASIC's role to take action against poor shares (a straw man argument the dregulator trots out with wearying predictability). It is, however, ASIC's duty to take action against manipulated shares.

It has become common practice for market manipulating criminals such as TTG and Investorlink to issue shares at headline prices to insider associates, in flimsy attempts to justify ramped prices. The criminal insiders are first quietly issued a large amount of shares at a low price. Later and in conjunction with share ramps, the insiders are issued few shares at a higher price in a publicized sham capital raising. This higher HEADLINE price and ramp is used to attract victims, while the criminals' actual weighted cost of shares is much lower. The most blatant recent case of this market manipulation was the Panorama Synergy scam, where criminals first were issued 347m shares at $0.003, later buying 20m shares at a $0.36 in a sham capital raising designed to provide justification for a ramp. In the case of TTG, the company issued 1m CDIs at $3.05 in July 2014, to provide justification for an openly manipulated "market" price. The shares were issued to a third party comically described as "unrelated to TTG, its Directors or any substantial shareholder".

According to ASIC, this is not a ramp and a revaluation fraud but rather a magical market mystery, a fantastic occurrence for which a logical explanation just cannot be found. ASIC and the ASX have approved TTG and given their guarantee it is not a manipulated securities fraud.

Saturday, 20 September 2014

The Linktone circular investment scam

MNC Media Investment Ltd (MIH.AX) is a criminal listed investment company that uses a maze of sham transactions with related parties to generate fraudulent results. Formerly known as Linktone (LTON), the company was delisted from NASDAQ in early 2014, purportedly to reduce the costs of SEC reporting obligations. Since Australia is vying to become an international center of fraud and money laundering, Linktone was naturally welcomed with open arms to the ASX. In September 2013, Linktone listed 24m CHESS Depositary Interests (CDIs) under the ticker LTL, corresponding to 240m ordinary shares. Being a revaluation fraud, Linktone CDIs did not actually trade on the ASX, but were merely set at a predetermined "market" price, legitimized and guaranteed by ASIC as unmanipulated. Incorporated in the Cayman Islands, MNC Media Investment conducts its purported business through dozens of interconnected subsidiaries in China, Hong Kong, British Virgin Islands and United Arab Emirates, all buying and selling themselves to each other.

MNC Media Investment has a long proud history of circular sham transactions between related parties. PT Media Nusantara Citra Tbk (MNCN), owned by PT Global Mediacom Tbk, bought 58% of MNC Media Investment in 2008, through its subsidiary MNC International Limited. In 2012, MNC International Limited sold its entire stake to Global Mediacom International Ltd, a wholly-owned subsidiary of the aforementioned PT Global Mediacom Tbk. Global Mediacom, described as "the largest and the only" integrated media group in Indonesia, sold MNC Media Investment to itself.

MNC Media Investment uses euphemistically named "short-term investments" to carry out its fraudulent circular investments, with such "short-term investments" ballooning on its balance sheet from $1m in 2006 to $89m in 2014. In 2010 MNC Media Investment bought $20m of secured notes from PT MNC Sky Vision, a subsidiary of PT Global Mediacom Tbk. In 2011, MNC Media Investment purchased 357m shares of PT Global Mediacom Tbk, which when sold in 2012 resulted in a $28m "profit" listed as "other operating income". MNC Media Investment used the proceeds to purchase 708m shares of PT Bhakti Investama, the holding company of PT Global Mediacom Tbk, 53m shares of PT Media Nusantara Citra Tbk and 65m shares of PT Sky Vision Tbk. These circular "investments" subsequently led to unrealized "profits". MNC Media Investment's cash flow from operations has been steadfastly negative, with $11.3m torched in 2010, $11.9m vaporized in 2011, $5.3m misappropriated in 2012 and $7.1m lost in 2013.

After several months of inactivity, the criminals decided to ramp MNC Media Investment in September 2014, doubling the "market" price in a straightline ramp on little volume.

According to ASIC, this is not a ramp and MNC Media Investment is not a circular investment scam. Instead, this is all a fabulous magic market mystery, and any granny investor that loses money in such a scam has no recourse to the law, but only themselves to blame.

MNC Media Investment has a long proud history of circular sham transactions between related parties. PT Media Nusantara Citra Tbk (MNCN), owned by PT Global Mediacom Tbk, bought 58% of MNC Media Investment in 2008, through its subsidiary MNC International Limited. In 2012, MNC International Limited sold its entire stake to Global Mediacom International Ltd, a wholly-owned subsidiary of the aforementioned PT Global Mediacom Tbk. Global Mediacom, described as "the largest and the only" integrated media group in Indonesia, sold MNC Media Investment to itself.

MNC Media Investment uses euphemistically named "short-term investments" to carry out its fraudulent circular investments, with such "short-term investments" ballooning on its balance sheet from $1m in 2006 to $89m in 2014. In 2010 MNC Media Investment bought $20m of secured notes from PT MNC Sky Vision, a subsidiary of PT Global Mediacom Tbk. In 2011, MNC Media Investment purchased 357m shares of PT Global Mediacom Tbk, which when sold in 2012 resulted in a $28m "profit" listed as "other operating income". MNC Media Investment used the proceeds to purchase 708m shares of PT Bhakti Investama, the holding company of PT Global Mediacom Tbk, 53m shares of PT Media Nusantara Citra Tbk and 65m shares of PT Sky Vision Tbk. These circular "investments" subsequently led to unrealized "profits". MNC Media Investment's cash flow from operations has been steadfastly negative, with $11.3m torched in 2010, $11.9m vaporized in 2011, $5.3m misappropriated in 2012 and $7.1m lost in 2013.

After several months of inactivity, the criminals decided to ramp MNC Media Investment in September 2014, doubling the "market" price in a straightline ramp on little volume.

According to ASIC, this is not a ramp and MNC Media Investment is not a circular investment scam. Instead, this is all a fabulous magic market mystery, and any granny investor that loses money in such a scam has no recourse to the law, but only themselves to blame.

Saturday, 13 September 2014

Conman Michael "Mick" Featherstone under investigation

Michael "Mick" Featherstone is a corrupt former Gold Coast police officer and self-confessed criminal, who with impunity has run various fraud schemes for decades. A dirty cop, Featherstone was suspected of planting drugs on suspects, stealing confiscated cash and forming alliances with bikie gangs. Despite (or perhaps because of) this he rose through the ranks of the rancid Gold Coast police force, at one point heading the Surfers Paradise Criminal Investigation Branch. Questioned by the 1997 Carter corruption inquiry regarding police involvement in the drug trade, Michael Featherstone was allowed to retire from the police force at age 33. Featherstone then started running cold-calling fraud schemes, protected by his links within the police force.

Featherstone is involved with a myriad of boiler room pyramid schemes, dodgy gambling syndicates, predictive software scams and other "investments", stealing millions of dollar from the gullible. After this blog detailed how Featherstone associates were listing a circular investment scam on the ASX (with ASIC's blessing of course), Featherstone started bombarding Google with take-down requests. In Australia, the criminals decide what information you are allowed to access, so the blog posts were blocked for Australian readers. This censorship can be bypassed by adding "/ncr" to bypass the automatic country redirect, allowing Australians to read the banned posts.

http://drbenway.blogspot.com/ncr/2013/12/avestra-asset-management-launches-new.html

http://drbenway.blogspot.com/ncr/2013/12/aha-avestra-and-formosa-auto-trade-scam.html

http://drbenway.blogspot.com/ncr/2014/01/avestra-hires-self-confessed-criminal.html

http://drbenway.blogspot.com/ncr/2014/04/conman-michael-featherstone-harasses.html

Michael Featherstone's criminal activities were common knowledge in the area, but he was untouchable due to his connections. Anyone asking questions was first politely told to shut up, and then had their lives threatened if they persisted. Featherstone's criminal activities, spanning decades, were openly protected by the putrid Gold Coast police force. A well-known criminal, Featherstone was "photographed socialising with senior serving officers, was endorsed online by a Brisbane inspector and even gave a speech at a recent send-off for a high-ranking Gold Coast officer".

https://au.news.yahoo.com/qld/a/24878932/michael-featherstone-former-senior-queensland-police-detective-investigated-over-alleged-fraud-links-to-bikies/

In September 2014, it was revealed that Michael Featherstone was under investigation from the Queensland's Crime and Corruption Commission (CCC). Referring Featherstone to the CCC, officers openly admitted that it was unfeasible to have the rank police conduct this investigation, given Featherstone's connections and the current level of corruptness within the force.

http://www.abc.net.au/7.30/content/2014/s4079648.htm

After Featherstone's offices were raided and investigations began over his links with fraudulent investment schemes, his criminal associates started distancing themselves from him and one fled overseas. And what about that ASX-listed fraud scheme that brought Mick to this blog? It is still in full operation, with ASIC's blessing. The fraudsters now instead use their corrupt corporate lawyers to spam take-down requests, in all likelihood misappropriating shareholder funds for this purpose. Naturally, there has been absolutely no mention of the Michael "Mick" Featherstone case in the Sydney Morning Herald, the largest "newspaper" in Australia.

Featherstone is involved with a myriad of boiler room pyramid schemes, dodgy gambling syndicates, predictive software scams and other "investments", stealing millions of dollar from the gullible. After this blog detailed how Featherstone associates were listing a circular investment scam on the ASX (with ASIC's blessing of course), Featherstone started bombarding Google with take-down requests. In Australia, the criminals decide what information you are allowed to access, so the blog posts were blocked for Australian readers. This censorship can be bypassed by adding "/ncr" to bypass the automatic country redirect, allowing Australians to read the banned posts.

http://drbenway.blogspot.com/ncr/2013/12/avestra-asset-management-launches-new.html

http://drbenway.blogspot.com/ncr/2013/12/aha-avestra-and-formosa-auto-trade-scam.html

http://drbenway.blogspot.com/ncr/2014/01/avestra-hires-self-confessed-criminal.html

http://drbenway.blogspot.com/ncr/2014/04/conman-michael-featherstone-harasses.html

Michael Featherstone's criminal activities were common knowledge in the area, but he was untouchable due to his connections. Anyone asking questions was first politely told to shut up, and then had their lives threatened if they persisted. Featherstone's criminal activities, spanning decades, were openly protected by the putrid Gold Coast police force. A well-known criminal, Featherstone was "photographed socialising with senior serving officers, was endorsed online by a Brisbane inspector and even gave a speech at a recent send-off for a high-ranking Gold Coast officer".

https://au.news.yahoo.com/qld/a/24878932/michael-featherstone-former-senior-queensland-police-detective-investigated-over-alleged-fraud-links-to-bikies/

In September 2014, it was revealed that Michael Featherstone was under investigation from the Queensland's Crime and Corruption Commission (CCC). Referring Featherstone to the CCC, officers openly admitted that it was unfeasible to have the rank police conduct this investigation, given Featherstone's connections and the current level of corruptness within the force.

http://www.abc.net.au/7.30/content/2014/s4079648.htm

After Featherstone's offices were raided and investigations began over his links with fraudulent investment schemes, his criminal associates started distancing themselves from him and one fled overseas. And what about that ASX-listed fraud scheme that brought Mick to this blog? It is still in full operation, with ASIC's blessing. The fraudsters now instead use their corrupt corporate lawyers to spam take-down requests, in all likelihood misappropriating shareholder funds for this purpose. Naturally, there has been absolutely no mention of the Michael "Mick" Featherstone case in the Sydney Morning Herald, the largest "newspaper" in Australia.

Thursday, 11 September 2014

The van Eyk circular investment scam collapses

van Eyk runs a circular investment cartel, with its listed and unlisted funds "investing" in each other instead of in actual assets, as first exposed by this blog post in November 2013. This related party fraud has been used to inflate management fees, overstate assets and control "market" prices. The cartel includes the listed van Eyk Blueprint Alternatives Plus (VBP.AX), in which cartel funds Blueprint Balance, Blueprint Capital Stable and Blueprint High Growth "invested". According to its latest annual report, these related parties held 67% of units in VBP as at June 2014. These three van Eyk funds also "invested" in the Blueprint International Shares Fund, which in turn "invested" money with related party hedge fund Artefact Partners, linked to current and past cartel members.

In August 2014, it was revealed that Artefact Partners had not invested as mandated, but instead funneled entrusted funds to an illiquid property fund, in all likelihood a related party of the Artefact criminals. This was in direct contravention of fund disclosure statements, constituting an open and direct act of fraud. Cartel associate Macquarie Investment Management was forced to suspend redemptions on the four van Eyk funds, in its capacity as responsible entity. The rats then started fleeing the sinking ship, with van Eyk's asset consultant team exiting under undisclosed circumstances. Investor outflows led Macquarie to terminate a further nine van Eyk cartel funds, and class action lawyers started to circle the disintegrating fraud scheme. Without related parties to fix its "market" price, VBP went bidless.

By engaging in transactions designed to benefit themselves, to the detriment of unitholders, the cartel directors breached their duty of care and committed fraud. The circular transactions and related party "investing" between van Eyk funds was criminal, regardless of any small print included in product disclosure statements. Past and present cartel directors are all jointly guilty of this fraud. The fingerpointing between the criminals predictably commenced quickly. Laughably, the managing director of van Eyk claimed he had "no idea" why Artefact would engage in related party fraud. Could it be for personal gain perhaps? After all, this is the exact same reason he himself committed securities fraud, so perhaps some self-reflection is in order.

Over the years, the van Eyk cartel criminals have siphoned millions of dollars from granny investors, by circularly "investing" in related party intermediaries instead of real assets. Even if the van Eyk funds are shuttered, this is no way means no money has been lost. If not for the fraud, every small investor in van Eyk funds would have had higher returns over the years, and they should be reimbursed after forensic accounting. This will of course never happen. ASIC protected the van Eyk cartel for years, and still protects numerous other related party fraud schemes following the exact same template. Most significantly, the implosion of the $800m circular investment scam received next to no mainstream media attention, despite its monumental implications. This debacle will be swiftly and silently swept under the carpet.

In August 2014, it was revealed that Artefact Partners had not invested as mandated, but instead funneled entrusted funds to an illiquid property fund, in all likelihood a related party of the Artefact criminals. This was in direct contravention of fund disclosure statements, constituting an open and direct act of fraud. Cartel associate Macquarie Investment Management was forced to suspend redemptions on the four van Eyk funds, in its capacity as responsible entity. The rats then started fleeing the sinking ship, with van Eyk's asset consultant team exiting under undisclosed circumstances. Investor outflows led Macquarie to terminate a further nine van Eyk cartel funds, and class action lawyers started to circle the disintegrating fraud scheme. Without related parties to fix its "market" price, VBP went bidless.

By engaging in transactions designed to benefit themselves, to the detriment of unitholders, the cartel directors breached their duty of care and committed fraud. The circular transactions and related party "investing" between van Eyk funds was criminal, regardless of any small print included in product disclosure statements. Past and present cartel directors are all jointly guilty of this fraud. The fingerpointing between the criminals predictably commenced quickly. Laughably, the managing director of van Eyk claimed he had "no idea" why Artefact would engage in related party fraud. Could it be for personal gain perhaps? After all, this is the exact same reason he himself committed securities fraud, so perhaps some self-reflection is in order.

Over the years, the van Eyk cartel criminals have siphoned millions of dollars from granny investors, by circularly "investing" in related party intermediaries instead of real assets. Even if the van Eyk funds are shuttered, this is no way means no money has been lost. If not for the fraud, every small investor in van Eyk funds would have had higher returns over the years, and they should be reimbursed after forensic accounting. This will of course never happen. ASIC protected the van Eyk cartel for years, and still protects numerous other related party fraud schemes following the exact same template. Most significantly, the implosion of the $800m circular investment scam received next to no mainstream media attention, despite its monumental implications. This debacle will be swiftly and silently swept under the carpet.

Tuesday, 9 September 2014

The Panorama Synergy ramp

Panorama Synergy (PSY.AX) is a listed securities fraud with links to corrupt politicians and convicted share manipulators. After issuing 347m shares at $0.003 in October 2013, bringing total number of outstanding shares to 474m, Panorama Synergy was ramped to $0.46 in sharply delineated steps over the next few months. This 15,000% ramp brought the company's "market" cap to $218m in September 2014. Before raising capital, Panorama Synergy had a net asset deficiency of $400K.

Purportedly a technology company, Panorama has had negative earnings and cash flows for the past ten years. According to its latest annual report, Panorama Synergy's assets comprise of $1.2m in newly raised cash and a licensing agreement with the University of Western Australia (UWA) for certain microelectromechanical devices. Although Panorama regularly uses misleading phrases such "the company's patented technology", Panorama does not actually own these patents, rather UWA does.

The purported basis for Panorama's "market" cap of $218m is a five-year licensing agreement with UWA, entered into in January 2014. Assuming that Panorama is not a blatantly manipulated listed fraud (which it is), the market value of this licensing agreement is therefore close to $218m. The natural question is then how much Panorama paid for this priceless licensing agreement? If UWA did not receive fair compensation for this invaluable licensing agreement, but rather gave it to a related party at lower than its market value, then UWA officials are guilty of fraud.

The Karam family has had previous business dealings with the Obeid crime family, as shown by ICAC hearings, although they later had a falling out over the botched Australian Water Holdings scam. (CORRECTION: This post originally and incorrectly stated that the company secretary of Panorama Synergy testified for ICAC. This is a different Anthony Karam.) Another director, Jeff Braysich, was convicted of share manipulation in 2007. The conviction was later overturned on a technicality. The scheme Braysich was convicted of used wash trades, i.e. sham trades between related parties, to fake market prices. Such wash trades could, for example, be used for ramps.

Purportedly a technology company, Panorama has had negative earnings and cash flows for the past ten years. According to its latest annual report, Panorama Synergy's assets comprise of $1.2m in newly raised cash and a licensing agreement with the University of Western Australia (UWA) for certain microelectromechanical devices. Although Panorama regularly uses misleading phrases such "the company's patented technology", Panorama does not actually own these patents, rather UWA does.

The purported basis for Panorama's "market" cap of $218m is a five-year licensing agreement with UWA, entered into in January 2014. Assuming that Panorama is not a blatantly manipulated listed fraud (which it is), the market value of this licensing agreement is therefore close to $218m. The natural question is then how much Panorama paid for this priceless licensing agreement? If UWA did not receive fair compensation for this invaluable licensing agreement, but rather gave it to a related party at lower than its market value, then UWA officials are guilty of fraud.

The Karam family has had previous business dealings with the Obeid crime family, as shown by ICAC hearings, although they later had a falling out over the botched Australian Water Holdings scam. (CORRECTION: This post originally and incorrectly stated that the company secretary of Panorama Synergy testified for ICAC. This is a different Anthony Karam.) Another director, Jeff Braysich, was convicted of share manipulation in 2007. The conviction was later overturned on a technicality. The scheme Braysich was convicted of used wash trades, i.e. sham trades between related parties, to fake market prices. Such wash trades could, for example, be used for ramps.

Sunday, 6 July 2014

HFA Holdings Limited and Bernie Madoff

HFA Holdings Limited (HFA.AX) is a revaluation fraud with a long sordid history, including involvement with Bernie Madoff through its US subsidiary. HFA was listed by fraudulent investment scheme MFS Limited (later rebranded as Octaviar), that collapsed in 2008 owing more than $2.7bn, having destroyed the lives of thousands of granny investors. Later the carcass of the fraudulent "cornerstone investor" provided a feeding frenzy for maggot liquidators. The HFA criminals then blamed their woes on "bad publicity".

In 2011, the trustees of Bernie Madoff's defunct business launched lawsuits to claw back funds from investors in feeder funds to the Madoff ponzi. HFA subsidiary Lighthouse Investment Partners LLC was sued for $11,162,251, as shown in this complaint. Having learned their lesson about the dangers of "bad publicity", the HFA criminals suppressed this information from being reported in mainstream Australian media. Australian media just pretended this did not happen, despite it being highly pertinent information for any reasonable person attempting to form a view of the HFA business. In Australia, the criminals decide what information you are allowed to access.

The top 20 shareholders control 90% of HFA and manipulate its share price. Being a listed securities fraud, HFA exhibits the standard pattern of long-term catastrophic shareholder value destruction, interspersed with sharp engineered ramps to benefit insiders. In January 2014, Apollo Global Management announced it was looking to exit its convertible note investment in HFA. HFA was then ramped 30% by the investment cartel, as part of a prearranged deal.

According to ASIC, none of this is market manipulation because market manipulation simply does not exist. ASIC need do nothing about share ramps, because share ramps do not exist.

Section 17.6 on page 35 of the 2013 HFA annual report describes the "relationship between remuneration policy and company performance" with inadvertent humor. The company performance justifying payment of USD$4.6m to its criminal management, taken directly from the remuneration report, is shown below.

But operational performance is entirely irrelevant to HFA's utility as a vehicle for securities fraud. HFA is yet again being used in revaluation fraud targeting granny investors. After the prearranged January 2014 ramp, investment cartel associate IOOF Holdings Limited (IFL.AX) immediately started buying millions of HFA shares at around $0.95. To pay back Apollo, HFA raised $16m at $0.90 by issuing shares to the investment cartel. Since the "market" price of HFA now has been brought to $1.12, millions of dollars in fraudulent unrealized profits have been manufactured, creating vast fees for the fund manager investment cartel controlling HFA's share price. The deliberately pumped HFA shares have been dumped on granny investors, packaged in products issued by IOOF Holdings and other cartel associates.

IOOF Holdings and the rest of the HFA investment cartel are engaged in premeditated securities fraud. What is the real difference between Bernie Madoff and the HFA investment cartel? There is but one: Bernie Madoff is in prison.

In 2011, the trustees of Bernie Madoff's defunct business launched lawsuits to claw back funds from investors in feeder funds to the Madoff ponzi. HFA subsidiary Lighthouse Investment Partners LLC was sued for $11,162,251, as shown in this complaint. Having learned their lesson about the dangers of "bad publicity", the HFA criminals suppressed this information from being reported in mainstream Australian media. Australian media just pretended this did not happen, despite it being highly pertinent information for any reasonable person attempting to form a view of the HFA business. In Australia, the criminals decide what information you are allowed to access.

The top 20 shareholders control 90% of HFA and manipulate its share price. Being a listed securities fraud, HFA exhibits the standard pattern of long-term catastrophic shareholder value destruction, interspersed with sharp engineered ramps to benefit insiders. In January 2014, Apollo Global Management announced it was looking to exit its convertible note investment in HFA. HFA was then ramped 30% by the investment cartel, as part of a prearranged deal.

According to ASIC, none of this is market manipulation because market manipulation simply does not exist. ASIC need do nothing about share ramps, because share ramps do not exist.

Section 17.6 on page 35 of the 2013 HFA annual report describes the "relationship between remuneration policy and company performance" with inadvertent humor. The company performance justifying payment of USD$4.6m to its criminal management, taken directly from the remuneration report, is shown below.

But operational performance is entirely irrelevant to HFA's utility as a vehicle for securities fraud. HFA is yet again being used in revaluation fraud targeting granny investors. After the prearranged January 2014 ramp, investment cartel associate IOOF Holdings Limited (IFL.AX) immediately started buying millions of HFA shares at around $0.95. To pay back Apollo, HFA raised $16m at $0.90 by issuing shares to the investment cartel. Since the "market" price of HFA now has been brought to $1.12, millions of dollars in fraudulent unrealized profits have been manufactured, creating vast fees for the fund manager investment cartel controlling HFA's share price. The deliberately pumped HFA shares have been dumped on granny investors, packaged in products issued by IOOF Holdings and other cartel associates.

IOOF Holdings and the rest of the HFA investment cartel are engaged in premeditated securities fraud. What is the real difference between Bernie Madoff and the HFA investment cartel? There is but one: Bernie Madoff is in prison.

Saturday, 5 July 2014

Hill End Gold Limited to join LionGold and Blumont cartel

Hill End Gold Limited (HEG.AX) is a related party revaluation fraud masquerading as a gold explorer. Like other manipulated shares, Hill End Gold features long-term shareholder value destruction interrupted by sharp manufactured ramps designed to benefit insiders.

After burning through millions in shareholder funds, the Hill End Gold criminals were seemingly approaching the end of the line, with ASX querying the company's ability to continue operating. As part of its response, Hill End Gold cited a "liquid" holding in related party Bassari Resources Limited (BSR.AX). In March, Hill End Gold had announced it was increasing its stake in related party Bassari by converting a loan at $0.008, bringing its total holding in the company to 14.7%. Starting in June, Bassari was then ramped to $0.021.

After burning through millions in shareholder funds, the Hill End Gold criminals were seemingly approaching the end of the line, with ASX querying the company's ability to continue operating. As part of its response, Hill End Gold cited a "liquid" holding in related party Bassari Resources Limited (BSR.AX). In March, Hill End Gold had announced it was increasing its stake in related party Bassari by converting a loan at $0.008, bringing its total holding in the company to 14.7%. Starting in June, Bassari was then ramped to $0.021.

According to ASIC, this was not a ramp because market manipulation does not exist, and therefore ASIC will do exactly nothing about it. As always. Bassari of course follows the standard pattern of manipulated shares, namely catastrophic long-term shareholder value destruction interspersed with short-term ramps designed to benefit insiders.

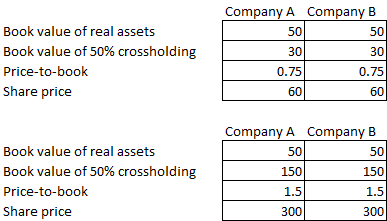

In June, the bellends at Hill End then announced they were selling their gold projects to LionGold Corp Ltd (A78.SI), part of the Blumont investment cartel, naturally with the consideration mainly in the form of LionGold scrip. The Blumont cartel uses crossholdings, revaluations and share ramping beyond NTA to create tremendous synthetic leverage, as first described by this blog post. Assume Company A and Company B each has $50 of real assets and a 50% shareholding in each other. Moving price-to-book from 0.75 to 1.5 quintuples the share price of both companies.

This is yet one more example of the Singapore-based criminal investment cartel making inroads on the Australian "market", while regulators in both countries twiddle themselves. The disastrous losses already suffered by victims of the Blumont cartel lie squarely at the feet of the complicit regulators, as do any further losses created by allowing these criminals to continue operating.

Thursday, 3 July 2014

The Macquarie Atlas Roads Group revaluation fraud

Macquarie Atlas Roads Group (MQA.AX) is an ASX-listed revaluation fraud masquerading as a toll road operator. An investment cartel headed by Macquarie controls the "market" price of MQA, and has ramped the stapled security in order to fraudulently obtain inflated management fees. The top 20 shareholders own 91% of MQA and control its share price. This revaluation fraud is the true purpose of MQA, the real reason for its creation and existence. At heart, MQA is no different from Fifth Element Resources.

Like other such scams, MQA is structured in a Byzantine maze of related parties, crossholdings, loans and sham transactions. MQA's annual report is deliberately deceptive, packed with accounting fraud designed to obscure a very simple business model. MQA's assets generate $49m of cash flows, of which the criminal managers absorb a base fee of $18m. After this 37% fee, the remaining $31m is available for distribution to victim investors. If MQA's share price was not openly controlled by a cartel, it would have collapsed. Instead it was ramped to a $1.6bn market cap, packaged in financial "products" and dumped on granny investors.

As a result of the ramp, the criminal managers entitled themselves to a staggering $58m "performance fee". No magical unicorns or leprechauns need be presumed to explain this straightline ramp. The explanation to this mystery is depressingly simple. A small group of criminals had the power to move the share price, and would benefit handsomely from doing so. So they did.

It is highly likely that the investment cartel that ramped MQA during the past year explicitly discussed their fraud in company emails and on recorded telephone lines, including the exact endpoint of their ramp. Macquarie is a criminal organization that considers itself above the law. But since ASIC operates a zero enforcement policy, this will never be investigated and the criminals will die as free rich men.

Like other such scams, MQA is structured in a Byzantine maze of related parties, crossholdings, loans and sham transactions. MQA's annual report is deliberately deceptive, packed with accounting fraud designed to obscure a very simple business model. MQA's assets generate $49m of cash flows, of which the criminal managers absorb a base fee of $18m. After this 37% fee, the remaining $31m is available for distribution to victim investors. If MQA's share price was not openly controlled by a cartel, it would have collapsed. Instead it was ramped to a $1.6bn market cap, packaged in financial "products" and dumped on granny investors.

As a result of the ramp, the criminal managers entitled themselves to a staggering $58m "performance fee". No magical unicorns or leprechauns need be presumed to explain this straightline ramp. The explanation to this mystery is depressingly simple. A small group of criminals had the power to move the share price, and would benefit handsomely from doing so. So they did.

It is highly likely that the investment cartel that ramped MQA during the past year explicitly discussed their fraud in company emails and on recorded telephone lines, including the exact endpoint of their ramp. Macquarie is a criminal organization that considers itself above the law. But since ASIC operates a zero enforcement policy, this will never be investigated and the criminals will die as free rich men.

Tuesday, 1 July 2014

The Fifth Element Resources Limited revaluation fraud

Fifth Element Resources Limited (FTH.AX) is a newly ASX-listed revaluation fraud masquerading as a gold explorer, as noted by this blog three weeks ago. The share price of FTH is openly manipulated, having been ramped from $0.20 to $2.30 in a month on no news. Prior to the ramp, an insider purchased 20m shares at $0.01 and the company conducted a sham related party capital raising of 20m shares at $0.20.

FTH has not fallen in price a single day of its existence, a track record as "perfect" as that of the Democratic Front for the Reunification of the Fatherland. According to ASIC and the mainstream media, this is not the result of a blatant market manipulation, but rather a marvellous but inexplicable magic market mystery. ASIC does nothing about market manipulation, allowing FTH to continue "trading" and attracting new victims, because according to ASIC market manipulation does not exist.

A revaluation fraud can be based on any type of business, or indeed an empty shell, as the real point of the scam is the manipulation of "market" prices. The purported underlying business is irrelevant. After manipulating purported "market" prices higher, ramped shares can be dumped on granny investors using fund manager associates. Alternatively, the ramped ASX-listed asset can be used to borrow against, with the proceeds then used for further manipulation. Throughout this, the operators and associates of such schemes collect real cash fees based on unrealized paper profits generated by themselves.

The problem for ASIC is that it has allowed this fraud to fester unchecked for decades, the cancer spreading to the point where its removal may not even be possible. It is not that the stock market tail is wagging the dog, the dog has been completely consumed, leaving nothing but a twitching rotting tail. The ASX is not a market with some elements of fraud, it is a fraud with some elements of market. There is no categorical difference between Fifth Element Resources or Intueri Group Limited (IQE.AX) or Veda Group Limited (VED.AX), they are on the same brownscale of fraud.

Most new Australian IPOs are now revaluation frauds, with investment cartels controlling the "market" outcome according to prearranged deals. Most IPOs in Australia are explicitly performed to create a controllable "market" price, not to raise money furthering an actual productive business with utility for society. Such scams commonly have the top 20 shareholders holding 95% of the shares outstanding.

FTH has not fallen in price a single day of its existence, a track record as "perfect" as that of the Democratic Front for the Reunification of the Fatherland. According to ASIC and the mainstream media, this is not the result of a blatant market manipulation, but rather a marvellous but inexplicable magic market mystery. ASIC does nothing about market manipulation, allowing FTH to continue "trading" and attracting new victims, because according to ASIC market manipulation does not exist.

A revaluation fraud can be based on any type of business, or indeed an empty shell, as the real point of the scam is the manipulation of "market" prices. The purported underlying business is irrelevant. After manipulating purported "market" prices higher, ramped shares can be dumped on granny investors using fund manager associates. Alternatively, the ramped ASX-listed asset can be used to borrow against, with the proceeds then used for further manipulation. Throughout this, the operators and associates of such schemes collect real cash fees based on unrealized paper profits generated by themselves.

The problem for ASIC is that it has allowed this fraud to fester unchecked for decades, the cancer spreading to the point where its removal may not even be possible. It is not that the stock market tail is wagging the dog, the dog has been completely consumed, leaving nothing but a twitching rotting tail. The ASX is not a market with some elements of fraud, it is a fraud with some elements of market. There is no categorical difference between Fifth Element Resources or Intueri Group Limited (IQE.AX) or Veda Group Limited (VED.AX), they are on the same brownscale of fraud.

Most new Australian IPOs are now revaluation frauds, with investment cartels controlling the "market" outcome according to prearranged deals. Most IPOs in Australia are explicitly performed to create a controllable "market" price, not to raise money furthering an actual productive business with utility for society. Such scams commonly have the top 20 shareholders holding 95% of the shares outstanding.

Saturday, 28 June 2014

The Independent Investment Research scam

Independent Investment Research Pty Ltd is a new scam backed by the Australian listed investment company cartel and its associates. Having chosen a deliberately misleading and deceptive brand name, the company provides commissioned research reports for listed and unlisted fraud schemes. After paying IIR to pump their scheme, criminals can quote "Independent Investment Research", while burying disclaimers in small print. This obviously sounds better than quoting "Commissioned Investment Research". IIR has intentionally and semantically sidestepped legal requirements to clearly disclose the nature of commissioned reports.

According to the Australian Competition and Consumer Commision (ACCC), it is illegal for businesses to make claims that are "likely to create a false impression". According to ACCC, businesses need to assess the "overall impression" of their claims, and "can't rely on small print and disclaimers as an excuse for a misleading overall message". ACCC has explicitly stated that “manufacturers cannot hide misleading claims in their brand names” in regards to water branding. However, consumer protection does not apply to financial products, the domain of the congenitally tardy ASIC. Due to the regulator's zero enforcement policy, most types of financial crime have effectively been legalized in Australia, including pump-and-dump schemes and price fixing. Ignoring the law, ASIC has unilaterally decided to allow fraud and the perversion of free markets.

IIR is used by various revaluation and pump-and-dump schemes that are so fraudulent they are usually avoided even by the moron mainstream media. These include previously exposed ponzi US Masters Residential Property Fund (URF.AX), revaluation frauds Sunbridge Group Limited (SBB.AX) and Disruptive Investment Group Limited (DVI.AX), as well as the criminal Australian listed investment company cartel. Managed Account Holdings Limited (MGP.AX) is one of the most recent cartel revaluation frauds covered by this "independent" investment research. Cartel member Argo Investments Limited (ARG.AX) recently bought a 9.25% stake in MGP for $0.12 per share. The loss-making MGP was then listed and immediately ramped to $0.25 by ARG and other related parties of MGP. ARG can now claim unrealized profits of 108% on its investment, that it created itself, based on which its criminal directors can charge real cash fees.

http://www.managedaccounts.com.au/Portals/0/Forms/IIR_Report_MGP_May14.pdf

The commissioned cartel research report for MGP mentions "independence" 53 times. Before even admitting to be a commissioned report in small print, "independence" is mentioned 13 times. Later in the Independent Investment Research report, the disclaimers start getting downright humorous. On the last page, IIR reveals it may:

According to the Australian Competition and Consumer Commision (ACCC), it is illegal for businesses to make claims that are "likely to create a false impression". According to ACCC, businesses need to assess the "overall impression" of their claims, and "can't rely on small print and disclaimers as an excuse for a misleading overall message". ACCC has explicitly stated that “manufacturers cannot hide misleading claims in their brand names” in regards to water branding. However, consumer protection does not apply to financial products, the domain of the congenitally tardy ASIC. Due to the regulator's zero enforcement policy, most types of financial crime have effectively been legalized in Australia, including pump-and-dump schemes and price fixing. Ignoring the law, ASIC has unilaterally decided to allow fraud and the perversion of free markets.

IIR is used by various revaluation and pump-and-dump schemes that are so fraudulent they are usually avoided even by the moron mainstream media. These include previously exposed ponzi US Masters Residential Property Fund (URF.AX), revaluation frauds Sunbridge Group Limited (SBB.AX) and Disruptive Investment Group Limited (DVI.AX), as well as the criminal Australian listed investment company cartel. Managed Account Holdings Limited (MGP.AX) is one of the most recent cartel revaluation frauds covered by this "independent" investment research. Cartel member Argo Investments Limited (ARG.AX) recently bought a 9.25% stake in MGP for $0.12 per share. The loss-making MGP was then listed and immediately ramped to $0.25 by ARG and other related parties of MGP. ARG can now claim unrealized profits of 108% on its investment, that it created itself, based on which its criminal directors can charge real cash fees.

http://www.managedaccounts.com.au/Portals/0/Forms/IIR_Report_MGP_May14.pdf

The commissioned cartel research report for MGP mentions "independence" 53 times. Before even admitting to be a commissioned report in small print, "independence" is mentioned 13 times. Later in the Independent Investment Research report, the disclaimers start getting downright humorous. On the last page, IIR reveals it may:

- Receive payment for the report

- Have a direct or indirect interest in recommended securities

- Buy or sell recommended securities

- Effect transactions that are "inconsistent" with its recommendations

- Infect your computer with viruses

Showing true panache, IIR caps this off by huffily proclaiming that its recommendations are "under no circumstances" ever influenced by any of this. Well, OK then.

Friday, 27 June 2014

The Wilson Foundation's "charitable" fraud

The Wilson Foundation marks a new nadir even for the sociopathic criminals running the Wilson Asset Management (WAM.AX) scam. Although the WAM criminals have stolen millions from granny investors through revaluation and accounting fraud, they have now sunk to a new unforgivable low point. In a despicable bid to reach new victims, the WAM criminals are starting a fraudulent "charity" designed to further their self-interest. Fraud is bad enough, but fraud in the name of charity is truly vile.

The Wilson criminals have taken over the defunct Australian Infrastructure Fund Limited (AIX.AX), planning to repurpose it and perform yet another one of their never-ending capital raisings. The key point (as always) is that this will increase funds under management for WAM and its associates. Jimmy Savile engaged in ostensibly "charitable" acts that allowed him access to new victims. In exactly the same way, the WAM sociopaths are attempting to lure new victims to the fraudulent and inflated listed investment company sector, by making claims of "charity".

WAM claims their new scam involves no self-interest, and that no fees will be charged by participants. This is an outright lie. WAM will own a significant stake in the proposed "charitable" fund. Subsequent upward revaluation of the fund will create unrealized profit for WAM, from which the sociopaths will charge real cash fees. The WAM directors stand to personally make millions from their "charity". They conveniently omit to disclose this.

Moreover, money entrusted by gullible victims to the "charitable" fund will increase funds under management of the cartel. Higher funds under management increases the investment cartel's ability to ramp chosen assets, creating yet more unrealized profits to charge fees from. There is absolutely nothing "charitable" about this fraud. If the Wilson sociopaths really wanted to give to charity, they could very easily do so in a way that would not financially benefit themselves. But these sociopaths cannot even understand the concept of charity without self-interest, cannot comprehend selflessness or love. Pity them, for they are not fully human.

How can the Wilson fraudsters even be allowed to use the word "charity" in their scam? Simple. There is no regulation of the word "charity", just as there is no regulation of "investment". A scheme can literally have fees of 100%, and still legally call itself an "investment". Customers of sausage enjoy more consumer protection. To use the word "sausage", there are set limits on how much canine feces the manufacturer can use. But in Australian financial crime, there are no limits and everything is permitted.

The Wilson criminals have taken over the defunct Australian Infrastructure Fund Limited (AIX.AX), planning to repurpose it and perform yet another one of their never-ending capital raisings. The key point (as always) is that this will increase funds under management for WAM and its associates. Jimmy Savile engaged in ostensibly "charitable" acts that allowed him access to new victims. In exactly the same way, the WAM sociopaths are attempting to lure new victims to the fraudulent and inflated listed investment company sector, by making claims of "charity".

WAM claims their new scam involves no self-interest, and that no fees will be charged by participants. This is an outright lie. WAM will own a significant stake in the proposed "charitable" fund. Subsequent upward revaluation of the fund will create unrealized profit for WAM, from which the sociopaths will charge real cash fees. The WAM directors stand to personally make millions from their "charity". They conveniently omit to disclose this.

Moreover, money entrusted by gullible victims to the "charitable" fund will increase funds under management of the cartel. Higher funds under management increases the investment cartel's ability to ramp chosen assets, creating yet more unrealized profits to charge fees from. There is absolutely nothing "charitable" about this fraud. If the Wilson sociopaths really wanted to give to charity, they could very easily do so in a way that would not financially benefit themselves. But these sociopaths cannot even understand the concept of charity without self-interest, cannot comprehend selflessness or love. Pity them, for they are not fully human.

How can the Wilson fraudsters even be allowed to use the word "charity" in their scam? Simple. There is no regulation of the word "charity", just as there is no regulation of "investment". A scheme can literally have fees of 100%, and still legally call itself an "investment". Customers of sausage enjoy more consumer protection. To use the word "sausage", there are set limits on how much canine feces the manufacturer can use. But in Australian financial crime, there are no limits and everything is permitted.

Thursday, 26 June 2014

ClearView Wealth abuses share buybacks to distort market pricing

In theory, share buybacks create value for shareholders by reducing number of shares outstanding and thus increasing cash flows, earnings and dividends per share. Such a theoretical value-adding buyback involves companies buying their shares at the lowest price attainable to achieve a long-term reduction in shares outstanding. In reality, this is almost never the case. "Increased EPS" is instead used a flimsy pretense to justify buybacks that are performed to directly move share prices. As an entirely accepted commonplace occurrence, criminal directors ramp "market" prices on which executive bonuses and options are awarded.

In Australia, companies have predictably taken this to ludicrous lengths. Criminal directors use share buybacks to ramp their price to predetermined and preannounced levels, breaching fiduciary duty by not seeking the lowest price possible. Companies alternate share issuing with share buybacks, with no reduction in shares outstanding achieved, or issue even more shares than they buy back. Companies will even perform share buybacks and share issuance at the same time, unequivocally admitting they are attempting securities fraud. Euphemisms such as "supporting the share" and "capital management" are commonly used for this securities fraud. In one of the most blatant cases of such fraud, ClearView Wealth Limited (CVW.AX) revealed a capital raising and buyback in the very same ASX announcement.

ClearView openly admitted it was going to attempt securities fraud, in a public announcement, and then proceeded to do so. ASIC of course did nothing whatsoever about this, in line with its zero enforcement policy. When companies perform buybacks explicitly to move market prices, due to the directors' "belief" that the share is undervalued, there is absolutely no justification for this in economic theory, it is open fraud. According to standard finance textbooks, what ClearView did is known as "share manipulation".

But how can Australian regulators, financial media and analysts condone companies explicitly admitting the deliberate distortion of market pricing? Simple. The dregulators, presstitutes and analysts simple assume market efficiency, that prices by definition are unramped and fair, and that higher prices thus always are better. According to ASIC, due to market efficiency share prices cannot be ramped, and so ASIC needs take no action when share prices are ramped.

Criminal listed investment companies commonly announce buybacks explicitly to ramp share prices to parity with NTA (or even beyond). Due to costs, the fair going concern value of listed investment vehicles is lower than NTA, and there is zero justification in economic theory for such vehicles to move their share price above their fair market value. Every director that has performed such a share buyback has not only breached their fiduciary duty to shareholders, but has also demonstrably distorted market prices and committed share manipulation.

If companies are allowed to set their own "market" prices with fraudulent buybacks, they no longer can be considered legitimate listed enterprises priced by a market, but are instead correctly referred to as listed securities frauds. The success of a company that sets its own "market" price is not determined by operational performance or fundamentals. Instead, the longevity of such a scam depends solely on the company's continual ability to raise capital to fund its price fixing. A listed company that sets its own "market" price is a ponzi.

Wednesday, 18 June 2014

The Queensland Bauxite Limited pump-and-dump

Queensland Bauxite Limited (QBL.AX) is a pump-and-dump scheme masquerading as a bauxite explorer. This blog first mentioned the QBL pump-and-dump two weeks ago in a post detailing various ramps orchestrated by Wholesale Investors and Proactive Investors. Since then, the cartel has continued roping in victims with ASIC's blessing and complicity, aided by the homunculi of Australian financial media. No matter how openly manipulated a share is, no matter how obviously ramped by criminals, Australian "journalists" are willing to spruik it. There is literally no scheme too fraudulent. On 13 June, The Motley Fool published a despicable "article" pumping the scam, claiming QBL was "set to soar".

http://www.fool.com.au/2014/06/13/queensland-bauxite-ltd-shares-set-to-soar/

The porcine shill who wrote this "article" should be ashamed of himself. At best, he is a complete moron, and at worst he is a criminal associate of pump-and-dumpers. The Queensland Bauxite securities fraud is operated by veteran share manipulators associated with Merlin Diamonds and the mysterious Gleneagle Securities. Before attaching his name to this pump-and-dump scam forever, The Motley Fool shill should have done some basic due diligence. The cartel ramped QBL from $0.010 to $0.059 in a couple of weeks, performing a complex array of leveraged transactions.

http://www.asx.com.au/asxpdf/20140617/pdf/42q89yzhxz0kdj.pdf

On June 18 QBL then collapsed by 58%. This had absolutely nothing to do with a "market" outcome. The price of QBL had been deliberately ramped by a cartel. Small investors got suckered in as an effect of the ramp, but were not the cause of it. Of course, such small investors can expect zero recourse to the law, because ASIC has effectively legalized pump-and-dump schemes and other revaluation frauds in Australia.

The QBL criminals pulled this exact same scam as recently as 2010. Guess Motley Fools have short memories as well as zero accountability. According to ASIC and the Motley Fool, these are just inexplicable magical market mysteries, and not deliberate ramps at all.

http://www.fool.com.au/2014/06/13/queensland-bauxite-ltd-shares-set-to-soar/

The porcine shill who wrote this "article" should be ashamed of himself. At best, he is a complete moron, and at worst he is a criminal associate of pump-and-dumpers. The Queensland Bauxite securities fraud is operated by veteran share manipulators associated with Merlin Diamonds and the mysterious Gleneagle Securities. Before attaching his name to this pump-and-dump scam forever, The Motley Fool shill should have done some basic due diligence. The cartel ramped QBL from $0.010 to $0.059 in a couple of weeks, performing a complex array of leveraged transactions.

http://www.asx.com.au/asxpdf/20140617/pdf/42q89yzhxz0kdj.pdf

On June 18 QBL then collapsed by 58%. This had absolutely nothing to do with a "market" outcome. The price of QBL had been deliberately ramped by a cartel. Small investors got suckered in as an effect of the ramp, but were not the cause of it. Of course, such small investors can expect zero recourse to the law, because ASIC has effectively legalized pump-and-dump schemes and other revaluation frauds in Australia.

The QBL criminals pulled this exact same scam as recently as 2010. Guess Motley Fools have short memories as well as zero accountability. According to ASIC and the Motley Fool, these are just inexplicable magical market mysteries, and not deliberate ramps at all.

Tuesday, 17 June 2014

The AMP Capital China Growth Fund fraud

AMP Capital China Growth Fund (AGF.AX) is an ASX-listed securities fraud masquerading as a Chinese bluechip fund. Using related party intermediaries, AMP has structured this scam so the fund manager absorbs almost all cash flows from held assets, leaving next to nothing for investor victims. Rigging the price of AGF with cartel associates including Select Investment Partners, AMP intermittently ramps AGF to create unrealized "profits". In the standard pattern of manipulated shares, AGF displays long-term catastrophic shareholder value destruction interspersed with ramps engineered to benefit insiders. This has absolutely nothing to do with a "market" outcome.

According to its annual report, AGF collects around $6.8m in dividends from its stock holdings in China A shares, of which it burns $6.4m, mostly as fees to the criminal managers. Given these ongoing costs, the going concern fair value of AGF to a small investor is around 7% of NTA. It is impossible for a director of such a scam to fulfil their fiduciary duty to investors, since this would mandate recommending they go elsewhere and avoid the swindle. Rather than get 7% of cash flows, investors could easily get 100%, and the sociopathic scum running these scams have a fiduciary duty to warn their investor victims about this.

AGF now functions as a listed securities fraud. By buying and then ramping AGF shares, criminal associate Select Investment Partners has created millions in unrealized "profits", fraudulently inflating its management fees and then dumping the deliberately bloated shares on granny investors through various funds. In the last month alone, Select Investment Partners has devoted millions to this fraud.

AMP and Select Investment Partners are perfectly aware of the fraudulence of their scheme. Since they deliberately engage in fraud, AMP and Select Investment Partners are criminal organizations. This is a simple statement of fact.

According to its annual report, AGF collects around $6.8m in dividends from its stock holdings in China A shares, of which it burns $6.4m, mostly as fees to the criminal managers. Given these ongoing costs, the going concern fair value of AGF to a small investor is around 7% of NTA. It is impossible for a director of such a scam to fulfil their fiduciary duty to investors, since this would mandate recommending they go elsewhere and avoid the swindle. Rather than get 7% of cash flows, investors could easily get 100%, and the sociopathic scum running these scams have a fiduciary duty to warn their investor victims about this.

AGF now functions as a listed securities fraud. By buying and then ramping AGF shares, criminal associate Select Investment Partners has created millions in unrealized "profits", fraudulently inflating its management fees and then dumping the deliberately bloated shares on granny investors through various funds. In the last month alone, Select Investment Partners has devoted millions to this fraud.

AMP and Select Investment Partners are perfectly aware of the fraudulence of their scheme. Since they deliberately engage in fraud, AMP and Select Investment Partners are criminal organizations. This is a simple statement of fact.

Morgan Stanley and the Galileo Japan Trust securities fraud

Galileo Japan Trust (GJT.AX) is an ASX-listed revaluation fraud masquerading as a Japanese real estate fund. Purportedly trading at a "market" price, in reality the share price of GJT is fixed by a cartel of fund managers consisting of Morgan Stanley, Macquarie Bank, Deutsche Bank and Allan Gray. After a "recapitalisation", this cartel deliberately ramped the "market" price of GJT, and then dumped the inflated shares on granny investors through various channels.

The criminals took $6m in direct fees from the "recapitalisation". They also charge real cash fees based on the unrealized "profit" they themselves engineered, with ramped GJT used as collateral for further fraud. This is not a matter of conjecture, it is a simple statement of fact. On June 12, Morgan Stanley received 4,791,489 shares of GJT as collateral. In the "recapitalisation", GJT raised money expressly for the purpose of reinstating distributions, since its held "assets" produce no actual cash flows whatsoever. There is a word for this too.

GJT was intentionally ramped until it was included in ASX300 index, allowing the criminals to unload some of the inflated shares on index funds mandated to blindly purchase such scams. This index inclusion fraud is now a common occurrence in Australia. The fund managers that pumped the price of GJT also dumped the shares on unwitting granny investors holding funds or life insurance products manufactured by the cartel. Given the immense arrogance of the criminals and tragicomical ineptitude of the regulators, it is highly likely the fund managers discussed their fraud in emails and recorded telephone conversations. They consider themselves untouchable.

The share price of GJT is openly manipulated by the cartel, to the point no reasonable person could even pretend a "market" determines its pricing. As a listed securities fraud, GJT follows the standard pattern of catastrophic long-term shareholder value destruction interspersed with ramps engineered to benefit insiders. Of course, according to ASIC this is just an inexplicable magical market mystery and not securities fraud at all.

This revaluation fraud is just as criminal as a bag snatching, and there is certainly no moral difference. However, the scammed grannies have zero recourse to the law, since these criminals control the regulators, legal system and media.

The criminals took $6m in direct fees from the "recapitalisation". They also charge real cash fees based on the unrealized "profit" they themselves engineered, with ramped GJT used as collateral for further fraud. This is not a matter of conjecture, it is a simple statement of fact. On June 12, Morgan Stanley received 4,791,489 shares of GJT as collateral. In the "recapitalisation", GJT raised money expressly for the purpose of reinstating distributions, since its held "assets" produce no actual cash flows whatsoever. There is a word for this too.

GJT was intentionally ramped until it was included in ASX300 index, allowing the criminals to unload some of the inflated shares on index funds mandated to blindly purchase such scams. This index inclusion fraud is now a common occurrence in Australia. The fund managers that pumped the price of GJT also dumped the shares on unwitting granny investors holding funds or life insurance products manufactured by the cartel. Given the immense arrogance of the criminals and tragicomical ineptitude of the regulators, it is highly likely the fund managers discussed their fraud in emails and recorded telephone conversations. They consider themselves untouchable.

The share price of GJT is openly manipulated by the cartel, to the point no reasonable person could even pretend a "market" determines its pricing. As a listed securities fraud, GJT follows the standard pattern of catastrophic long-term shareholder value destruction interspersed with ramps engineered to benefit insiders. Of course, according to ASIC this is just an inexplicable magical market mystery and not securities fraud at all.

This revaluation fraud is just as criminal as a bag snatching, and there is certainly no moral difference. However, the scammed grannies have zero recourse to the law, since these criminals control the regulators, legal system and media.

Friday, 13 June 2014

Fund intermediaries and credit creation

If fund intermediaries are allowed to disregard costs and fix their unit price at NTA, this will introduce a systemic source of overvaluation. The ongoing fair value of a fund to a non-controlling investor is equal to the NTA less costs as proportion of asset cash flows. For example, a fund that every year burns 20% of the cashflows generated by its assets has a fair value of 80% of NTA. Funds that set prices above this fair value during times of net investor inflows are deliberately defrauding their investors, as they could not support this price were there sustained net investor outflows. On an aggregate level, such fund intermediaries engage in a completely unregulated and unrecognized credit creation process.

Assume Fund A invests in Asset X, and has management costs equalling 20% of the cash flows generated by this investment each year. Since 80% of the cash flows reach the owners of Fund A, the fair value of the fund would as noted be 80% of NTA. Now assume instead Fund A invests in Fund B that invests in Fund C that invests in Asset X, with each fund manager taking 20% of received cash flows. Since 51% of the cash flows now reach the owners of Fund A, the fair value of Fund A is 51% of NTA. The remaining 49% of cash flows from Asset X are absorbed by the fund managers.

Assume Fund A invests in Asset X, and has management costs equalling 20% of the cash flows generated by this investment each year. Since 80% of the cash flows reach the owners of Fund A, the fair value of the fund would as noted be 80% of NTA. Now assume instead Fund A invests in Fund B that invests in Fund C that invests in Asset X, with each fund manager taking 20% of received cash flows. Since 51% of the cash flows now reach the owners of Fund A, the fair value of Fund A is 51% of NTA. The remaining 49% of cash flows from Asset X are absorbed by the fund managers.

| Fund A | Fund B | Fund C | Asset X | |

| Cashflow to owner | 51% | 64% | 80% | 100% |

| Cashflow to fund manager | 13% | 16% | 20% |

Despite the funds having fair values ranging from 51% to 80% of NTA, all three can fix their price and issue units at NTA, with all three claiming the full right to the same cash flow. In effect, this means the cash flows from Asset X are rehypothecated into 149%, since 100% of the cash flows are promised to investors and 49% absorbed by the fund managers in aggregate.

In aggregate, fund intermediaries and their price-fixing are a form of shadow banking and contribute to the credit creation process, since they create "assets" that can then be used as collateral for lending. In the example above, if Asset X was worth $1bn, the intermediaries have created a further $490m through deliberate fraud, conjuring $490m worth of collateral from thin air into the economy. If all fund intermediaries in an economy fix their unit price at NTA, the aggregate amount of credit creation this entails is equal to aggregate intermediary costs. In Australia, given the high total cost of fund intermediaries, this synthetic leverage has a significant - and entirely ignored - impact on credit creation.

Wednesday, 11 June 2014

Lionhub Group Limited launches new revaluation fraud

International criminals increasingly use the Australian stock exchange to perpetrate revaluation frauds, creating phantom collateral they can borrow against, with the loan proceeds used for further fraud. Most recently, Singaporean criminals backdoor listed LionHub Group Limited (LHB.AX) on the ASX, taking over a dormant shell company in order to create a fake "market" price. After various sham related party transactions and a fraudulent capital raising, LionHub now has 757m shares outstanding and $6.5m cash in the bank. Although LionHub issued less than 5% of shares in the capital raising, the issue price of $0.20 implied a "market" value of $151m for the company.

Magically, the $6.5m in cash has been revalued to a $151m ASX-listed asset, guaranteed by ASIC to be unmanipulated. This fraudulent asset can then be used as collateral for debt, or be dumped on unwitting grannies by associated criminal fund managers. The top 20 shareholders own 95% of LHB, and after reinstatement to listing on June 12 the share price will be controlled by this cartel, creating a fake "market" value.

Shell companies for revaluation frauds are openly marketed in Australia by criminal enterprises such as Wholesale Investors, which also offer to ramp share prices and supply local sham directors and company secretaries. LionHub has connections to Sino Australia Oil & Gas (SAO.AX) and other related party frauds, sharing the same criminal associates. These manipulated frauds follow the standard pattern of long-term shareholder value destruction interspersed with sharp ramps engineered to benefit insiders.

ASIC and media alike regard the fraudulent ramps as magical market mysteries, enigmatic and wonderful occurrences for which there just can be no explanation. New revaluation fraud Fifth Element Resources (FTH.AX) issued 21m shares at $0.20 in a fraudulent capital raising, after which the share price was ramped to $0.95 in a month. Prior to the capital raising and ramp, an insider had purchased 20m shares at $0.01.

According to ASIC, this is not a ramp and FTH is not an openly manipulated share, because if it were ASIC would have done something. According to ASIC, this is all just a magical market mystery, and so ASIC lets it continue trading freely and attract more victims.

Magically, the $6.5m in cash has been revalued to a $151m ASX-listed asset, guaranteed by ASIC to be unmanipulated. This fraudulent asset can then be used as collateral for debt, or be dumped on unwitting grannies by associated criminal fund managers. The top 20 shareholders own 95% of LHB, and after reinstatement to listing on June 12 the share price will be controlled by this cartel, creating a fake "market" value.

Shell companies for revaluation frauds are openly marketed in Australia by criminal enterprises such as Wholesale Investors, which also offer to ramp share prices and supply local sham directors and company secretaries. LionHub has connections to Sino Australia Oil & Gas (SAO.AX) and other related party frauds, sharing the same criminal associates. These manipulated frauds follow the standard pattern of long-term shareholder value destruction interspersed with sharp ramps engineered to benefit insiders.

ASIC and media alike regard the fraudulent ramps as magical market mysteries, enigmatic and wonderful occurrences for which there just can be no explanation. New revaluation fraud Fifth Element Resources (FTH.AX) issued 21m shares at $0.20 in a fraudulent capital raising, after which the share price was ramped to $0.95 in a month. Prior to the capital raising and ramp, an insider had purchased 20m shares at $0.01.

According to ASIC, this is not a ramp and FTH is not an openly manipulated share, because if it were ASIC would have done something. According to ASIC, this is all just a magical market mystery, and so ASIC lets it continue trading freely and attract more victims.

Tuesday, 3 June 2014

Axstra Capital and Wholesale Investors pump-and-dump